Geld Drucken Uberall

Metallwoche International – mit Egon von Greyerz

„Geld drucken überall“

Mit einem weiteren EU-Gipfel kurz vor uns und mittlerweile wieder erstarkten Gold und Silberpreisen, sprechen wir heute mit Egon von Greyerz über den Markt, aber auch über die Schuldenkrise weltweit und wie er die Situation aus der Schweiz heraus beurteilt. Egon von Greyerz ist Gründer und Managing Partner von Matterhorn Asset Management (MAM) und ihrer Edelmetallabteilung – GoldSwitzerland, beheimatet in Zürich in der Schweiz…

Von Greyerz ist regelmäßig in den Medien vertreten, so auch auf CNBC und BBC und spricht zudem auf Investmentkonferenzen überall auf der Welt. Er veröffentlicht Artikel zur Weltwirtschaft und zum Vermögenserhalt auf Webseiten, wie The Daily Reckoning, JSMineset (Jim Sinclair), Zerohedge, GATA, Casey Research und ist häufiger Gast bei James Turk von Goldmoney und Eric King von Kingworldnews.

Das Interview mit Egon von Greyerz ist in englischer Sprache, eine schriftliche Übersetzung finden Sie weiter unter auf der Seite. Am Mikrofon: Michael der „Düsseldorfer“. Viel Spaß!

Themen des Interviews:

- EU Gipfel und Schuldenproblematik

- Es werde Geld

- EZB und IWF

- Die Deutsche Rolle

- US Swap Geschäfte

- Refinanzierungsbedarf der Euroländer

- Refinanzierungsbedarf der Banken

- Politik der Fed – Welche Politik?

- Bleibt Griechenland im Euro?

- Finanzielle Repression

- Sorgen um Rentner und Rentensyteme

- Die gigantische Derivateblase

- Schweizer Franken und Euro

- Das Schweizer Bankensystem heute

- GoldSwitzerland und physische Edelmetallanlagen

- Die Schweiz – sicher und stabil auch heute noch?

- Die Goldbestände der Zentralbanken

- Manipulationen der offiziellen Zahlen?

- Die Bullionbanken und die NY Comex

- Minenwerte – Potential und Risiken

- Gold und Silber ist Geld

- Vermögenserhalt im Vordergrund

Geld Drucken Uberall

Egon von Greyerz covers these topics in two recent interviews with King World News and Metallwoche in Germany.

King World News interview with Egon von Greyerz 30 January:

“Gold Market Positioned for Massive Upside Move”

Frank Meyer’s Die MetallWoche 29 January (audio and written):

“Money Printing Everywhere”

This latter interview is also in German for our German readers.

King World News brief report from Egon von Greyerz posted on the KWN blog on January 30.

Gold Market Positioned for Massive Upside Move

Today Egon von Greyerz told King World News that central bank balance sheets are expanding at a dangerous rate and this is a recipe for an explosion in gold and silver prices. Egon von Greyerz is founder and managing partner at Matterhorn Asset Management out of Switzerland. Here is what von Greyerz had to say about central bank activity and how it will impact gold and silver prices: “I’ve been looking at the explosion of the balance sheets of the central banks and it’s just astonishing to see how much money they are printing and how their balance sheets are expanding. We have the absolute perfect recipe for hyperinflation and thus a massive increase in the price of gold and silver.”

Today Egon von Greyerz told King World News that central bank balance sheets are expanding at a dangerous rate and this is a recipe for an explosion in gold and silver prices. Egon von Greyerz is founder and managing partner at Matterhorn Asset Management out of Switzerland. Here is what von Greyerz had to say about central bank activity and how it will impact gold and silver prices: “I’ve been looking at the explosion of the balance sheets of the central banks and it’s just astonishing to see how much money they are printing and how their balance sheets are expanding. We have the absolute perfect recipe for hyperinflation and thus a massive increase in the price of gold and silver.”

January 30, 2012

Egon von Greyerz continues:

“It’s not just the ECB balance sheet that’s gone up in the last six months or even the last three months by hundreds of billions of dollars. It’s the same with the Fed, Bank of Japan, The Bank of England and the Swiss National Bank, they are all exploding. This can lead to only one thing and the market seems to be totally ignorant of this.

The repercussions are going to come very soon. As I said, this can only lead to one thing, an explosion higher in gold and silver prices and the beginning of the massive inflation, which will lead to hyperinflation.”

When asked about the Fed announcement last week, von Greyerz replied, “The Fed action is totally consistent with what we’ve said for some time. The Fed knows they have to continue to print money and they will print unlimited amounts of money. On top of this, the US is not taking any measures whatsoever to cut down on spending.

“Every year the Fed is printing between $1.5 trillion and $2 trillion. As you know, just during President Obama’s term the debt in the US has gone up by about $4.5 trillion. This is about 30% of total borrowing in the US. It’s just incredible and it’s accelerating.

But they are not the only central bank doing this. The ECB is in the same mess. The ECB is meeting again, but I would be surprised if they come to any decision. Greece will probably default because they won’t accept the EU having control over their finances. The EU doesn’t want Greece to default because it would be bad for the other European countries, so they will probably come up with a package. I don’t expect that package will be now, but at some point in the future.”

When asked about the action in gold and silver, von Greyerz responded, “The move in gold, so far, looks extremely good. I’m always pleased that we don’t have a straight move up, although I do think we will have faster moves higher in the not too distant future. This is strong action with small corrections.

We are at $1,730 today and I think within the next couple of months we will certainly be touching $1,900 and continuing higher from there. I don’t think $1,900 will be a stopping point for very long.

I really like the action of silver. Silver still hasn’t broken out like gold has, but as I said to you last time, I expect that to happen soon. It will break out around the $37 level. That’s going to happen very quickly because the gold/silver ratio is moving down nicely, but I think it will soon accelerate lower and silver will move a lot faster to the upside than gold.

So I can see $37 being taken out within the next 30 days and then we will just start flying from there. It won’t take long to get up to $50 again.”

When asked about the mining shares, von Greyerz stated, “I like them here. We’ve started buying them. We prefer physical bullion, but we’ve now started buying mining shares because they are massively undervalued and they will move a lot faster than the metals.

As I said, I like them now and I think it’s the right time for investors to buy them or add to positions because I think an acceleration higher in the mining shares is coming.”

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

Geld Drucken Uberall

Metallwoche international – presents Egon von Greyerz „Money printing everywhere“

With another EU- Summit just in front of us and Gold and Silber strengthening again, we speak to Egon von Greyerz not only about the market, but also about the worldwide debt crisis and how he judges the situation with his view out of Switzerland. Von Greyerz is the Founder and Managing Partner of Matterhorn Asset Management (MAM) and its Precious Metals Division – GoldSwitzerland, based in Zurich Switzerland.

Egon von Greyerz makes regular media appearances such as on CNBC and BBC and also speaks at investment conferences around the world. He also publishes articles on the world economy and wealth preservation which are featured on websites such as The Daily Reckoning, JSMineset (Jim Sinclair), Zerohedge, GATA, Casey Research, , 321Gold, 24hGold, Gold Eagle and many others. EVG is a frequent guest with James Turk of Goldmoney and Eric King from Kingworldnews.

We talk to Egon about the current situation in Europe, the problems with debts, the role of the ECB and the IWF, Greece and how Germany will handle the situation. We talk about the gigantic bubble in derivatives, threatening developments concerning the pension funds, the role of the central banks, manipulation of gold, the bullion banks and much more. Von Greyerz gives us also an interesting update on his current view on Switzerland. Is it still a safe and stable country you can rely on and store your physical precious metals safely? And of course we talk about his views on Gold and Silver.

The interview with Egon von Greyerz was done by Michael, from Metallwoche.de

Enjoy the show!

Geld Drucken Uberall

Von Greyerz – Gold Breaking Out, Will Hit New All-Time Highs

The full interview before the not unexpected Fed announcement of Jan 25, 2012:

With gold attacking the critical $1,680 level and silver remaining strong above $32, today King World News interviewed the man who told clients in 2002, when gold was $300, to put up to 50% of their assets into physical gold. Egon von Greyerz is founder and managing partner at Matterhorn Asset Management out of Switzerland. When asked about the recent action in gold, von Greyerz said, “Sometimes we get lucky with our calls. I called the bottom of gold when we talked around the end of December. When we spoke last week I said it looks to me like silver is going to break out here and this is exactly what is happening. This is very good action and it’s as we expected.”

Egon von Greyerz continues:

“Silver is leading and the gold/silver ratio is coming down quite rapidly. I think we will see a strong fall in the gold/silver ratio. This just means silver will continue to go up faster than gold. When looking at gold, on a closing basis, it has already broken out. We might see some sideways action around these levels, but gold is breaking out and is on its way to new highs in my view.

Silver has a little way to go before it breaks out, that’s around the $37 level (the breakout). But, again, the action in silver is very good and I think we could go higher quite quickly. So, overall, very good action and I think it will continue….

“I think the next few months we will see very strong action and I could see a rapid move back to the highs of $50 and then through that level, to new highs, after a bit of consolidation. So gold and silver are going to move very quickly to the upside.

This is more of a dollar move right now. If you look at gold in other currencies, it is more or less going sideways here. So the fall of the dollar is helping with this move. For gold to rise against all currencies at once is unusual, but longer-term gold will continue to rise against all of the currencies.”

When asked about the mining shares, von Greyerz stated, “They have bottomed and as we both know they are substantially undervalued. I see major moves taking place in the mining shares. A lot of this action in gold is linked to QE. The ECB is printing money now by lending, banks in Europe, massive amounts of money. They lent, just before Christmas, 500 billion euros and they are continuing to lend major amounts.

Without this lending the banks will not survive, especially the French and the Spanish banks. Just last week they had about 15 billion from the ECB. So, the ECB lends them money and this is a different form of QE.

By lending the banks money, what do the banks do with the money? Well, they borrow the money for nothing or at 1% and give the ECB toxic debt, in return, as security. Then they buy government bonds for the money they get. So the ECB gets the money back again. It’s just incredible, it’s a form of a Ponzi Scheme, combined with money printing.

The banks are improving their balance sheets and the ECB just keeps printing money. This is what gold is reacting to. We also know the Fed is doing a similar thing with their currency swaps. So QE is there and will accelerate. Without that the banking system, as I’ve said, will not survive.”

Geld Drucken Uberall

Silver Shortages & Gold to Accelerate Higher

With gold closing above the critical $1,650 level and silver above $30, today King World News interviewed the man who told clients in 2002, when gold was $300, to put up to 50% of their assets into physical gold. Egon von Greyerz is founder and managing partner at Matterhorn Asset Management out of Switzerland. When asked about the recent action in gold, von Greyerz said, “We like the action and it’s exactly what we’ve been predicting. My view is that we have bottomed and we are on the way to much higher levels. We are seeing a bit of sideways action here, but it’s sideways to upward and I think that will continue. I like the pace, the fact that it’s not going up too fast, but I think we will see an acceleration to the upside in short order.”

Egon von Greyerz continues:

“I look at the banks here in Europe and they are an absolute mess, even before the French downgrade. We deal with French banks and they’ve had their lines cut by billions and billions. They couldn’t trade, and that was before the downgrade. It must be even worse for them now. This is what you are seeing in a lot of banks around Europe.

This just confirms we are very near a massive package of QE here because if they don’t do it there won’t be any banking system left here in Europe. Because of that I’m seeing big buyers coming into gold and even bigger buyers becoming very interested. So there is definitely a shift.

We are seeing steady demand, even as gold was turning down at the end of the year. Now, in January, we are seeing demand keeping up, extremely strong. So, there seems to be a totally different attitude to gold now and I expect for there to be incredible demand for 2012. We are just seeing the very beginning of it

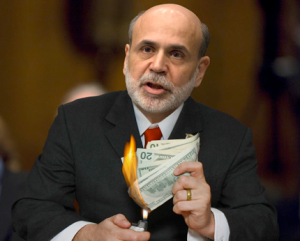

Central bankers don’t even understand gold. Most of them don’t even understand why they have it. If you listen to (Fed Chairman) Bernanke, he doesn’t have a clue as to why the US has it. As a matter of fact, as you know, he probably doesn’t have it anyway. The US simply doesn’t have the 8,100 tons of gold they say they possess…

Click here to continue reading the Egon von Greyerz interview on the KWN Blog

Geld Drucken Uberall

“LASST SIE KONKURS GEHEN“

Der Anlageberater John Mauldin erklärt seine Haltung gegenüber Sparmaßnahmen; einer Rückkehr des Goldstandards; der Euro-Krise; und der Bereitschaft zur Rettung eines jeden, die den Kapitalismus und die Geldsysteme zu funktionieren aufhören lässt.