Gold and Silver poised for a major move

Gold and Silver poised for major move.

December 10 2012

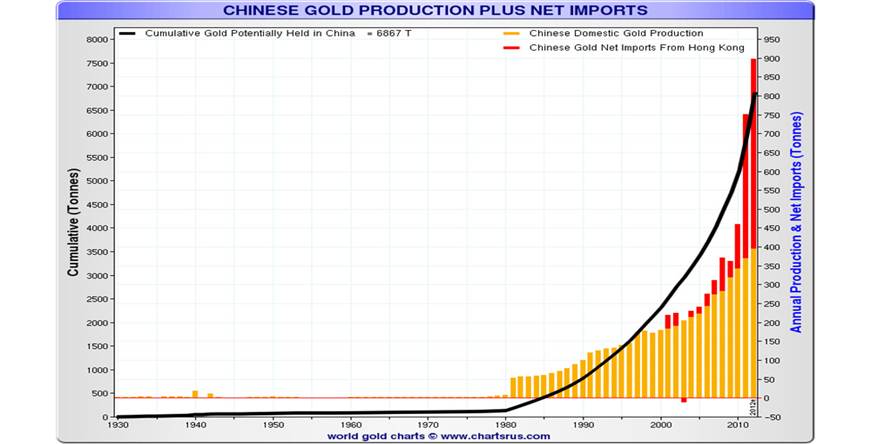

The major operators of the paper market in precious metals are using all the ammunition they have available to suppress the price of gold and silver. But they have an extremely powerful opponent in China which continues to increase the gold imports at a remarkable rate. In 2012 China has so far imported 500 tons of gold against 375 tons for 2011. Total Chinese production and imports for 2012 is 900 tons against 750 last year. (chart courtesy Nick Laird of chartsrus.com)

Alasdair Macleod discusses that the Futures Market in precious metals is heading for a major crisis due to the massive outstanding short positions of US banks in gold and silver. http://www.financeandeconomics.org/gold-futures-market-heading-for-crisis/ A major short squeeze could be imminent.

Regularly when GoldSwitzerland transfers what should be client’s physical allocated gold bars from Swiss banks to vaults outside the banking system , the bank does not actually have the physical but must acquire it. Paper gold outstanding is around 100 times the amount of physical gold available. Thus all paper holders can never get physical delivery. This also goes for most ETFs.

The fundamental and technical picture could not be better for gold and silver. Most governments’ deficits are escalating at a fast rate. Money printing worldwide is likely to accelerate rapidly and could reach exponential rises in the next 1-3 years.

Gold and Silver will continue to reflect the destruction of paper money but must be held in physical form and stored outside a very fragile financial system.

The next target for Gold is still $4,500-5,000 and for Silver $150. These targets could be reached in the next 12-18 months. Longer term targets are much higher.

These issues and much more are covered in my recent interview with King World News:

Link to Dec 7 KWN written interview

Link to Dec 7 KWN audio interview

Egon von Greyerz

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

About Edward Maas

Edward Maas

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD