HYPERINFLATION will drive gold to unthinkable heights

HYPERINFLATION WILL DRIVE GOLD TO UNTHINKABLE HEIGHTS

by Egon von Greyerz

We now live in a world where governments print worthless pieces of paper to buy other worthless pieces of paper that combined with worthless derivatives, finance assets whose values are totally dependent on all these worthless debt instruments. Thus most of these assets are also worth-less. (more…)

HYPERINFLATION will drive gold to unthinkable heights

Egon von Greyerz’ macro analysis @ the Stansberry & Associates Alliance Member Conference in Zurich, Nov 2010.

Below you can view the 45 minute video created from Egon von Greyerz’ presentation at the Alliance Member conference with courtesy of Stansberry & Associates Investment Research.

If somehow you cannot see this video with the correct Windows Media Player plugin in Internet Explorer please download the much faster and modern Google Chrome browser in just a few seconds here

and add the Firefox plugin for this video here

The Firefox plugin works in Mozilla Firefox and Google Chrome browsers.

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

HYPERINFLATION will drive gold to unthinkable heights

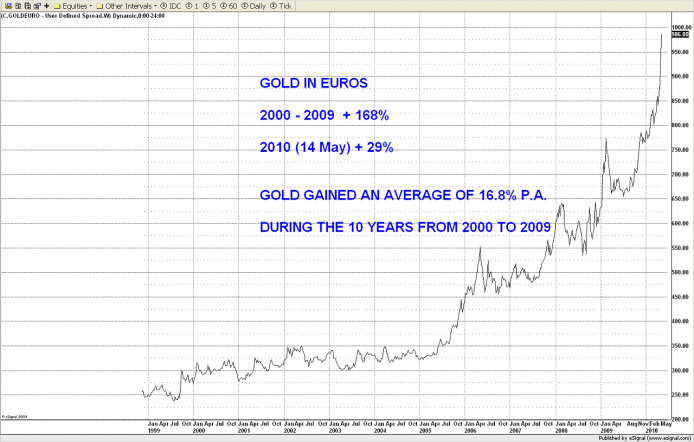

Fundamental and technical factors for gold are now in total harmony and gold is entering a virtuous circle that will drive the price up at its fastest pace since this bull market started in 1999.

- It is a fact that gold in US dollars (and many other currencies) has gone up 400% in eleven years or 16% per annum annualised.

- It is a fact that the US dollar has declined 80% in value against gold since 1999.

- It is a fact that the dollar and most other currencies have gone down 98-99% against gold since 1913 when the Federal Reserve Bank of New York was created.

- It is also a fact that the Dow Jones (and many world stock markets) has declined over 80% against gold since 1999.

- It is a fact that gold has made a new all time monthly closing high in dollars in August 2010.

Gold trend

We expect gold to start a substantial rise now which will continue for 5-10 months before any major correction. Gold’s technical picture is extremely strong with a continuous rising pattern of higher highs and higher lows with the steepness of the curve increasing. From much higher levels we are likely to see a correction that could last up to a year before the next rise which will last several years before we see a significant peak. Once gold has topped we do not expect the same kind of decline as after the 1980 peak since gold is likely to become part of a future reserve currency. At that point gold will be a solid but unexciting investment with very little upside potential. But that is likely to be a few years away.

In spite of a 5 times increase in the value of gold or an 80% decline against many currencies and stockmarkets in the last 11 years, most investors own no gold and still do not understand the importance and value of gold. In a world of constant money printing and credit creation leading to devaluing currencies and devaluing assets, gold reflects stability and is virtually the only store of value that cannot be destroyed by governments.

The average asset manager, fund manager, pension fund or private individual owns no physical gold and at best has a very small exposure to some precious metals stocks. And in spite of this gold has gone up over 400% in 11 years. How is that possible? For the simple reason with the relatively modest demand that we have seen in the last few years, there is not enough physical gold even at these levels. The increase in demand that we have seen has most probably been satisfied by central banks leasing or lending their gold to the bullion banks. Central banks supposedly own 30,000 tons of gold but unofficial estimates of their real holdings are at 15,000 tons or less.

So what are the factors that are likely to lead to a major rise in the gold price?

We have for several years outlined in our Newsletters the problems in the world that inevitably will lead to massive money printing and a hyperinflationary depression (see for example “Alea Iacta Est” and “There Will Be No Double Dip…” on the Matterhorn Asset Management website).

There are three insurmountable problems:

- Real unemployment at 22% in the US will continue to go up

- The budget deficit will increase dramatically due to the problems in the economy and in a few years time the interest on the Federal Debt is likely to be higher than tax revenues.

- None of the problems in the banking industry have been solved but merely swept under the carpet by phoney valuations of toxic debt with the blessing of governments. The circa $20 trillion that were pumped into the world economy to save the financial system in 2008-9 have had a very short term beneficial effect but solved none of the problems.

The effect of this massive $20 trillion infusion has been ephemeral since we are entering the autumn of 2010 with virtually every single economic indicator and statistic in the US deteriorating rapidly. With interest rates already at zero there is no ammunition left but one. And it is this specific last bullet that will be used to infinity in the next few years and starting very soon, namely UNLIMITED MONEY PRINTING. Every single area of the US economy will need support or printed money, whether it is the federal government, the states, the municipalities, banks, pension funds, insurance companies, the unemployed, corporations, health care, housing market, commercial real estate, individuals, etc, etc, etc. The list is endless and many other countries will follow.

Before we talk about gold in hyperinflationary terms, let’s look at where gold is likely to reach in today’s money.

Three realistic Gold targets: $6,000 – $7,000 – $10,000:

- In the 1971 to 1980 gold cycle, gold went from $35 per ounce to $850 or up over 24 times. If we were to see the same increase in this cycle, gold would rise to over $6,000.

- The gold peak at $850 in 1980 corresponds to over $7,000 today adjusted for real inflation based on the inflation rate as calculated by John William’s Government Shadow Statistics (shadowstats.com)

- Gold and gold mining shares were an average of around 25% of world financial asset between 1921 and 1981. Today, gold and mining shares are only 0.9% of world financial assets. If gold and mining shares were to go to 25% of financial assets, gold would go to over $31,000. But even if we assume that world financial asset would go down by 2/3rds from here that would put gold at over $10,000.

The three historical comparisons above (and see chart below) would put gold anywhere from $6,000 to $10,000 and this is without inflation, or more likely hyperinflation. In a hyperinflationary environment, the price gold will go to is really irrelevant since it depends on how much money is printed. In the Weimar Republic for example gold went to the equivalent of DM 100 trillion (Papiermark). What is more important is that gold is likely to go up at least 5 times from today without inflation and with hyperinflation gold will protect investors against the total destruction of paper money and many other assets.

Wealth Protection

Gold must only be held in its physical form and the holder of gold must have direct access to the gold. We consider ETFs, gold in a bank (whether allocated or unallocated), fractal ownership of physical gold, futures or any other form of paper gold as very risky and a totally unsatisfactory method for owning gold. Physical gold should preferably be stored outside your country of residence and outside the banking system. The holder must have direct access to the vaults where the gold is stored.

Silver

Silver has been lagging gold since its peak at over $21 in 2008. For the last few months the gold/silver ratio has been consolidating between 58 and 71. The ratio is currently around 64 and is likely to start a move down to new lows below the 2006 low at just 44. So this is very good news for silver which is likely to outpace gold substantially in the next few years. Silver is probably the most undervalued precious metal today and has great potential.

But there are many caveats for silver:

- It is an extremely volatile metal and is definitively not for the fainthearted.

- We only recommend physical silver owned directly by the investor.

- Physical silver currently weighs 64 times more than gold for the same amount invested and is circa 120 times bulkier (due to its lower density).

- Therefore silver is not as practical as gold as a means of payment.

- Also, silver is subject to Vat (value added tax) in all European countries. Thus silver cannot be moved freely across borders.

- Physical silver for investment purposes can be bought/sold and stored tax-free in Switzerland but if the investor takes possession, Vat must be paid.

Due to the above factors investors should carefully consider the split between physical gold and silver.

Stockmarkets

At the beginning of July this year we sent out a message to investors that, based on our proprietary indicators, we expected stockmarkets to finish the correction up at the end of July and resume the major downtrend in August. We also said that gold would start its major rise in August. And this is exactly what has happened so far.

We now expect major falls in all stockmarkets worldwide over a sustained period. We would not be surprised to see the Dow down to the 1,000 area (in today’s terms) before this bear market in over. But it will not be a straight line and there will be extreme volatility. When hyperinflation sets in, stockmarkets will have a major but temporary surge.

The only stocks that investors should hold are precious metals stocks and possibly some resource and food stocks. But it must be remembered that stocks do not represent the same degree of wealth preservation as physical precious metals held directly by the investor.

Currencies

Currencies should in the next few years be looked upon as a necessary evil and not as a store of value. All currencies will continue to decline against gold, just as they have in the last 11 years and in the last 100 years. Due to money printing by most governments, we will have a fierce game of competitive devaluations by virtually all central banks. We have seen the Euro and the pound weaken substantially and the next currency the speculators will jump on is the US dollar. The dollar is grossly overvalued, partly due to the weak Euro, and is likely to weaken significantly due to the problems in the US economy.

Currencies only reflect relative value and not absolute value since they can be and are printed until they reach their intrinsic value of zero. It is a fallacy to measure the value of a currency relative to another currency since they are all losing value. Currencies should only be measured against real money which is gold. This is the only method that reveals governments’ deceitful actions in destroying the value of paper money. Therefore it is a mug’s game to speculate or invest in currencies since they will all decline in an extremely volatile and unpredictable market.

So are there currencies which are likely to perform better on a relative basis for funds that have to be held in paper money? We believe that Norwegian kroner, Swiss Franc, Canadian Dollar, Singapore Dollar, Australian Dollar and Renminbi will perform relatively better than many other currencies.

Government Bond Markets

The bond market is the biggest bubble in financial markets worldwide, in our opinion. Investors around the world are worried about the state of financial markets and therefore believe that government bonds represent a safe haven. These investors will receive the most enormous shock on two accounts. Firstly, no government will be able to repay the debts outstanding. So there will either be government defaults, moratoria, or money printing that totally destroys the value of the bonds. Secondly, interest rates are likely to go up significantly to at least 10-15%, totally destroying the value of the bonds.

Conclusion

We are now entering a period when most major asset classes and in particular stocks, bonds and currencies are starting a major decline. Since most financial assets in the world are invested in these three categories plus real estate which will also decline, we are likely to experience major shocks and crises in the financial system and the world economy. Wealth protection is now more important than probably at any other time in history. Physical gold and possibly other precious metals directly controlled by the investor will be a vital part of a wealth preservation portfolio.

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

HYPERINFLATION will drive gold to unthinkable heights

CNBC Squawk Box Europe interview with Egon von Greyerz from the Zurich Stock exchange, August 19, 2010

Watch the interview here.

HYPERINFLATION will drive gold to unthinkable heights

A Newsletter “THERE WILL BE NO DOUBLE DIP…..” by Egon von Greyerz has been posted on the Matterhorn Asset Management website:

“YNo, there will be no double dip. It will be a lot worse. The world economy will soon go into an accelerated and precipitous decline which will make the 2007 to early 2009 downturn seem like a walk in the park…… ”

To read the Newsletter on MAM click the following link:

https://vongreyerz.gold/2010/08/16/there-will-be-no-double-dip/

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

HYPERINFLATION will drive gold to unthinkable heights

NEIN, DAS WIRD KEIN DOUBLE DIP…..

by Egon von Greyerz – Matterhorn Asset Management

Englisch-Deutsch-Übersetzung von MMnews Felix Fabich

Nein, das wird kein Double Dip. Es wird viel schlimmer. Die Weltwirtschaft wird bald einen beschleunigten und härteren Abschwung erleben, welcher die Verluste zwischen 2007 und Anfang 2009 wie einen Spaziergang aussehen lassen werden.

Das globale Finanzsystem war vorübergehend künstlich am Leben gehalten worden durch Milliarden von gedruckten Dollar, welche die Regierungen „Geld“ nennen. Aber der Effekt dieses gewaltigen Gelddruckens ist kurzlebig, da es nicht möglich ist die auf wertlosem Papier aufgebaute Weltwirtschaft durch selbiges zu retten. Dennoch werden die Regierungen weiterhin Geld drucken, da dies die einzige ihnen bekannte Abhilfe darstellt.

Deswegen werden wir bald in eine Gelddruckphase nie dagewesener Größenordnung kommen. Aber das wird die westliche Welt nicht vor einem Abschwung bewahren, der 20 Jahre, sehr wahrscheinlich wahrscheinlich viel länger dauern wird.

Das Ende der Epoche

Die hyperinflationäre Baisse in den westlichen Ländern – auch in den U.S.A. und Großbritannien – wird das Ende einer 200-jährigen Epoche seit der industriellen Revolution markieren. Der Großteil des Wachstums in den letzten 100 Jahren und noch spezifischer in den letzten 40 Jahren basiert auf einem unhaltbaren Wachstum der Kreditniveaus. Diese Schulden werden in den nächsten Jahren noch um einige Größenordnungen wachsen, bis die kommende Hyperinflation in der westlichen Welt zu einer Zerstörung der Immobilienpreise und einer Schuldenimplosion führt.

In den letzten 100 Jahren hat die westliche Welt ein nie vorher dagewesenes Wachstum der Produktion und Innovation erlebt. Dies führte zu einem signifikanten Anstieg der Lebensqualität. In demselben Zeitraum wuchsen die öffentlichen und privaten Schulden exponentiell und führten zu einem steilen Anstieg der Inflation im Vergleich zu den Jahrzehnten zuvor.

NEIN, DAS WIRD KEIN DOUBLE DIP…..

by Egon von Greyerz – Matterhorn Asset Management (more…)

HYPERINFLATION will drive gold to unthinkable heights

Link: Western Economies Face Hyperinflation: Gold Bull

HYPERINFLATION will drive gold to unthinkable heights

Yes this is it! We have crossed the Rubicon and events in the world economy are now likely to unfold in a totally uncontrollable fashion. Clueless governments still don’t understand that it is their ruinous actions that have created a credit infested and bankrupt world. They will continue to prescribe the same remedy that caused the problem in the first place, namely more credit and more printed money. The consequences are clear; we will have hyperinflation, economic and human misery as well as social unrest.

When will the world finally begin to understand that we have reached the point of no return and that “the voyage of their life is bound in shallows and in miseries” (Shakespeare, Julius Caesar). Sadly, we are probably not very far from that point. It is already starting to happen in many countries.

The latest EU and IMF package of $ 1 TRILLION (Euro 750 billion) is yet another futile attempt by governments to abolish poverty by printing paper. Let’s be absolutely clear, this money does not exist and the EU governments are hoping by declaring such a large amount that they can con the Wolfpack speculators. At this point the EU has just picked a large round figure out of the air. But when their bluff is called by the Wolfpack and the next attack happens, EU governments will after initial huffing and puffing start printing unlimited amounts of paper.

So the world is now on its road to ruin and there is no action, no leader and no new amount of printed money that can save the world or prevent a hyperinflationary depression.

Never in history has the world been in a situation when virtually all industrialised countries are bankrupt. Therefore there is no precedent for what will happen in the next few years. What we can be quite certain about is that events will happen in a seemingly random pattern and that it will be impossible to forecast where the next crises will start.

But although we will not be able to predict in what order events will take place, we can expect much of what is outlined below to happen.

Wolfpack attacks

Already back in 2007 we warned about the very high risk of the CDS (credit default swap) market. This is now one of the primary instruments used by the Wolfpack (expression coined by the Swedish Finance Minister Borg). The Wolfpack, speculators with enormous fire power such as hedge funds and investment banks, use the CDS market to attack any weak financial sector, be it a country, a bank or a company. The combination of the leverage of the CDSs and the massive capital available to the Wolfpack makes it possible for them to bring down or badly maul whatever they attack. It was not the Wolfpack that caused the problem in for example Greece but they can bring down a weak victim quickly and profit immensely and immorally from it.

There are so many weak potential victims that the Wolfpack can attack and they will start with the most vulnerable ones like, Portugal, Spain and Ireland etc. But when the time is right they will also attack the US and the UK.

So in the coming year we will see country after country coming under attack from the Wolfback which will lead to acceleration in money printing and higher interest rates.

Iceland – Ireland – Greece – Who is next?

The EU support package of $ 1 trillion is supposed to be sufficient to protect the rest of Europe from another Greek tragedy. The dilemma with such a massive EU commitment is that no government expects to have to pay the money out. If they did the voters in the respective EU countries would throw out their government. Why should the German people, who are also having hard times, pay for the Greeks, Portuguese or the Spaniards, especially since these loans will never be paid back.

Greece is bankrupt but is still taking on additional EU loans of € 140 billion. In addition, their austerity measures are supposed to bring the deficit down from 12% of GDP today to 3% in a few years time. But who can be so stupid as to lend to a bankrupt nation which will sink into the Ionian and Aegean Seas in the next few years. With massive cuts in government expenditure, with major falls in output, with unemployment rising fast, with tax revenues collapsing how can Greece possibly be expected to improve the economy and pay a high interest rate on their exploding debt? In addition, as long as they have the Euro they will be totally uncompetitive. So if they couldn’t manage their economy in the so called good times, it is absolutely guaranteed that they have no chance of surviving in bad times. So Greece will default and so will Portugal, Spain, Italy, France, the UK, the US and many more. But before that there will be the most colossal worldwide money printing exercise which would have used up most of the trees in the world but for electronic fiat money.

So, if virtually bankrupt nations don’t cut their deficits, they will definitively go under and if they try to cut, they will also go under due to collapsing output and tax revenues and colossal debts. Thus whatever actions governments take or don’t take, they are damned.

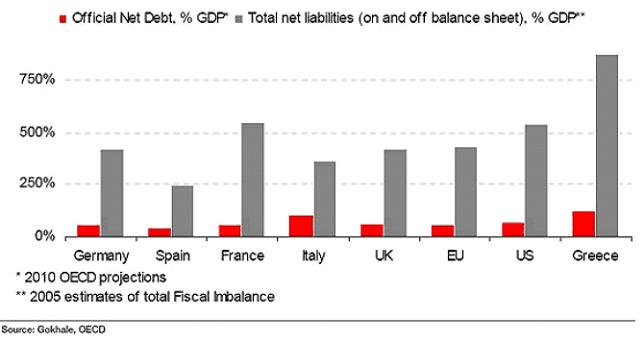

The table below shows debt as a percentage of GDP for various OECD countries. The official debts (in red) are massive and unlikely to ever be repaid in real money. Total debts (grey bars) include unfunded liabilities such as pensions and health care. Spain has the lowest total debt to GDP of 250%. Germany and the UK have around 400%, the US over 500% and Greece over 800% debt to GDP. These figures are absolutely astronomical and prove that most governments in the world will be totally incapable of repaying their debts or funding the pensions or medical care which they have committed to. It doesn’t matter however much governments cut expenditure or raise taxes, all these countries are insolvent and nothing can save them.

The world must permanently readjust

Most governments still believe that deficit spending and money printing is the solution to all their problems. Because the world economy’s expansion in the last 100 years and particularly in the last 40 years has been primarily based on credit and not real growth, governments live under the false impression that money printing will work this time too. But we have reached the point when investors will no longer buy worthless government debt that will never be repaid with real money. We will first go through a period when governments issue and buy their own debt thus monetising the debt or print money. This will be the hyperinflationary phase. Thereafter the world will realise that none of the government debt and very little of the bank debt will ever be repaid. Credit will then implode and so will also the assets financed by credit. Eventually there will be a new monetary and financial system and the world will start afresh. The adjustment period will be very long and will involve economic and human misery, leading to social unrest and major political change. It will be a horrible experience for the world during this extended period of adjustment. But it will be like a forest fire that clears out the deadwood and creates the conditions for strong new growth. Once the new era starts it will therefore be from a very much lower level and individuals will be rewarded for hard work with little or no social security safety net. Credit will only be granted for sound capital investment projects, not for consumption or speculation. Ethical and moral values will return and the golden calf will not be worshipped. But before that, the period of readjustment will be very long and extremely difficult for the whole world.

Hyperinflation

For several years we have predicted that hyperinflation is the most likely outcome of the economic predicament that the world is in. But it is unlikely to be a straightforward hyperinflationary period. Precious metals will be the primary beneficiaries of hyperinflation. Certain commodities, especially food and energy, will also go up in price. But most assets that have been financed by the credit boom will go down in real terms. This includes property, stocks and bonds. In hyperinflationary money these assets could still go up in price. If someone who earned $ 50,000 per annum in real money now earns $ 5 million in newly printed money, his house will probably also go up in nominal terms. But in real terms property prices will decline massively. There will be no credit available and interest rates will be very high, probably at least 15-20% so very few people will be able to buy a house.

Hyperinflation will destroy many currencies so paper money will definitely reach its intrinsic value which is zero. Gold and silver will virtually be the only assets that will protect investors fully against the destruction of money.

The next leg of the debt crisis is here

In our February newsletter “Sovereign Alchemy will Fail” we discussed the Sovereign Time Bomb and we are now experiencing the initial small explosions with Greece as the first victim. The $1 trillion EU/IMF rescue package was never intended to be more than a headline figure. EU governments were hoping that this would frighten the Wolfpack away. But so far this has failed. The Euro went up 4 cents when the package was announced but is now down to new lows again. How can anyone take a massive rescue package seriously when most of the countries making the commitments are bankrupt themselves? Spain and Italy have committed tens of billions each. And they are the ones that will be attacked by the Wolfpack next. This is the bankrupt saving the bankrupt. The IMF has no money but is dependent on its members of which the US is the biggest contributor. And they are bankrupt too. The UK, which is not in the Euro Zone and which has a worse budget deficit than Greece, contributed £15 billion. The new UK government is planning to cut a massive £ 6 billion of costs out of its next year’s budget which will bring major hardship. But as a last act, the outgoing labour government committed £15 billion which if paid out will never be repaid. The whole thing is a total farce. Governments commit trillions to rescue banks and sovereign states but cannot even make budget cuts of a few billion in their own countries. This shows that the world economy and the world financial system is being run by morons who only have their own self interest in mind and do not understand the consequences of their ruinous actions.

When the $1 trillion EU rescue package was announced, the US simultaneously offered European banks dollar Swap facilities (dollar loans) of a minimum $500 billion but probably much more. In addition the US Fed also injected at least $500 billion into the US banking system. These actions make it clear the banking system is under tremendous strain similar to 2008. But this is just the beginning. Things will get a lot worse.

Gold

In 2002 we advised investors to put up to 50% of their liquid assets into gold when the price was $300. To us it was crystal clear that the mountain of debts and derivatives would never be repaid with normal money but would be inflated away by money printing and this is what is now happening. The media are now talking about a bubble in gold and comparing to the 1980 top at $850. Let us be very clear, although gold has gone up 5 times since the 1999 bottom at $250, it is nowhere near its peak. Adjusted for real inflation (as per shadowstats.com) the 1980 gold peak in today’s prices corresponds to around $7,200 today. So gold could easily go up 6 times from the current price of $1,220 and still be within normal parameters.

There are many factors that will contribute to gold’s rise from here (in addition to money printing):

- Gold production is going down.

- Neither Comex (the futures exchange), nor the bullion banks would be able to deliver more than a fraction of the physical gold for which they have outstanding commitments.

- Central banks and the IMF probably don’t hold even half of the 30,000 tons that they claim they have. Most likely, at least 15,000 tons (6 years gold production) have been sold to suppress the gold price.

- The precarious financial system will lead to a total distrust of paper gold including most of the ETFs which have no physical gold.

The four factors above will lead to the most massive surge in the gold price. There will be nowhere near sufficient gold to satisfy demand at current prices. We had been expecting gold to start its acceleration in March 2010 and this is exactly what is happening. We expect the move to be relentless during most of this year with very few major corrections but with high volatility. Moves of $100 in one day could easily happen.

So gold is likely to make a top in the next few years between $5,000 and $10,000. But if we get hyperinflation the price could go exponentially higher like in the Weimar Republic when gold reached DM 100 trillion per ounce in 1923. Will gold experience the same type of correction when is has peaked as happened after the 1980 peak? Probably not, because gold is likely to be a part of a new monetary system that will be created when the current one has collapsed.

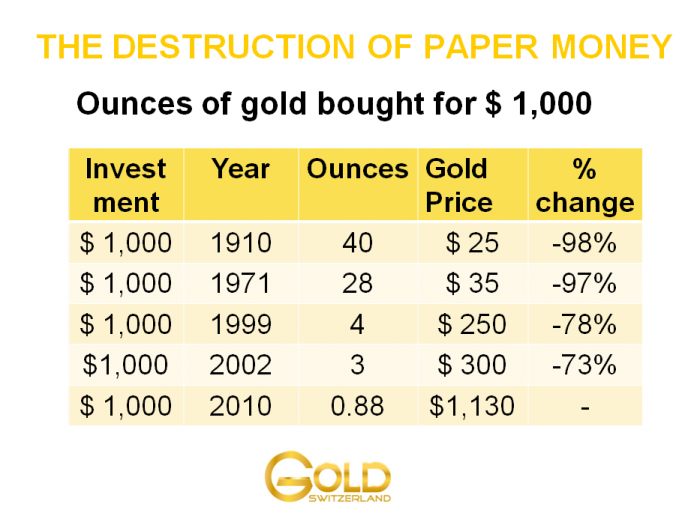

The table below illustrates the total destruction of paper money against gold in the last 100 years and shows how many ounces of gold that $1,000 bought at various times. In 1910, $1,000 bought 40 oz of gold at $25 per oz. Today in 2010, $1,000 buys 0.80 oz of gold at $1,230 per oz. This is a massive decline of 98% in the value of the dollar measured in real terms in the last 100 years. The next significant year is 1971 when Nixon abolished the convertibility of dollars to gold. It was this disastrous decision that opened the floodgates for the credit and money creation that we are experiencing currently. The dollar is down 97% since then. But even if we take more recent years, the purchasing power of the dollar measured in gold has declined catastrophically. Since the 1999 gold low, the dollar has declined by 80% against gold and since 2002 (when Matterhorn Asset Management recommended major gold investments) by 76%.

Virtually all currencies show similar declines in value against gold in the last 100 years. This is the clearest evidence of governments and central banks defrauding their people of their hard earned money. Where will it end? It will end when the dollar and many other currencies reach their intrinsic value of ZERO. That time is not far away.

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

HYPERINFLATION will drive gold to unthinkable heights

A Newsletter “SOVEREIGN ALCHEMY WILL FAIL” by Egon von Greyerz has been posted on the Matterhorn Asset Management website:

“When we look at the world economy today, wherever we turn we see a wall of risk. And sadly this is an insurmountable wall with risks that are totally unprecedented in history. There has never before been a potentially catastrophic combination of so many virtually bankrupt major sovereign states……… ”

To read the Newsletter on MAM click the following link:

https://vongreyerz.gold/2010/02/11/sovereign-alchemy-will-fail/

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

HYPERINFLATION will drive gold to unthinkable heights

Egon von Greyerz interview with BBC Radio, 15 January 2010

Egon von Greyerz, the founder of GoldSwitzerland today did a 4 minute interview with BBC 5 Live – Wake up to Money.

In the introduction to the interview the BBC presenter says:

According to Egon von Greyerz a leading gold commentator, gold could reach $10,000 per oz due to the state of the world paper currencies. He has released a hard hitting analysis of the effects of toxic loans and printing of money to prop up the economies. Egon von Greyerz, a former Deputy Chairman of Dixons and now Managing Partner of GoldSwitzerland, also states that we could see hyperinflation and the collapse of the dollar.

The interview should be regarded as a typical example of popular media’s absolute faith in paper money and misunderstanding of real money i.e. gold.

But the public’s perception of gold will change dramatically in the next 12-18 months. With the likely major decline of currencies like the dollar and the pound and the resurgence of problems in the financial system, the coming rapid appreciation of gold will make major headlines. At that point the media will totally change their attitude and treat gold with the respect that it requires as the only surviving currency of the last 6,000 years.

Gold at $1,135 will be regarded as an absolute bargain in 12 months time.

CLICK HERE for Egon Von Greyerz’ BBC 5 Radio Interview 15thJan2010

CLICK HERE for Egon Von Greyerz’ BBC 5 Radio Interview 15thJan2010

An MP3 player will open in your browser.

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.