42% Of All The Gold In The World Buys 5 Companies ONLY

“This is the new normal”! That is what a professional advisor stated at a recent family office conference in London after I had outlined the global risks due to the credit and asset bubbles.

This is what is so frightening about any top in the economy. Peak optimism and peak asset prices normally go hand in hand. I did not experience the 1929 crash or the depression, but a few quotes from that time expresses the normal euphoria at a market peak.

“We in America today are nearer to the final triumph over poverty than ever before in the history of any land. The poorhouse is vanishing from among us.” Edgar Hoover in 1928

“There is no cause to worry. The high tide of prosperity will continue.” Andrew Mellon, Treasury Secretary, September 1929

“Stock prices will stay at high levels for years to come.” Professor of business, Ohio State, Oct 13, 1929

Well we all know what happened. On October 29, 1929, the Dow crashed and bottomed in 1932 at 90% lower and there was a depression in the US. “No cause to worry”, “New normal”! Well, human optimism has no boundaries.

Stock market always goes up!

Looking at the Dow chart above, all the corrections, with the exception of 1929, seem relatively small due to the exponential nature of the chart. But when you are right in it, a 40% or 50% fall is very dramatic and painful. And we must remember that all market falls are totally unexpected by everybody, including investors, governments and economists.

Anyone observing the chart above would say that the Dow is in a long-term uptrend. So the expression “stock markets always go up” seems correct. The only problem is that corrections can be very painful and wipe many investors out. Also, sometimes you might have to wait a very long time to recover. For example, after the 1929 peak it took 25 years until the market had recovered the loss.

A 50% fall in the Dow would be totally normal. That would take us to the 2000-2010 area. But due to the over-extension of this debt fuelled market. I would expect a 90% fall at least like after 1929. That would take the index back to around the 2,000 level which we saw in 1987.

Getting older is not always an advantage but it does give you lots of experience. I have had a front row seat at every major market fall since the early 1970s. In 1972, I joined a UK photographic retailer called Dixons. My first options were at 132 pence. At the bottom of the market in 1974 the stock was down to 9 pence, a 93% fall. Luckily, I didn’t have so much to lose at a young age but did buy more shares at 11 pence. Dixons was still profitable and the balance sheet was strong. But as a consumer durable stock it had a very high beta factor (moved faster than the market). But we did survive the shock which included an oil crisis and a coal miners’ strike which involved only having electricity 3 days a week in the stores. Eleven years later we had built Dixons to a FTSE 100 company and the leading electrical, electronic retailer in the UK. Just as people today believe that the current bull market will go on forever, we thought in 1974 that the depressed times would never end.

The Dow is running on empty

Thus, the highest likelihood, just observing the Dow’s and other markets’ uptrend, is that it will go on forever with temporary corrections. But that conclusion does not take into account how the meteoric rise has been achieved. The explanation is of course simple. Since the creation of the Fed in 1913, there has been an explosion of credit and money printing. This has been the primary driver of all asset markets, including, stocks, bonds and property. Nixon closing the gold window in 1971 really turned on the afterburners since thereafter debt and inflation have grown exponentially.

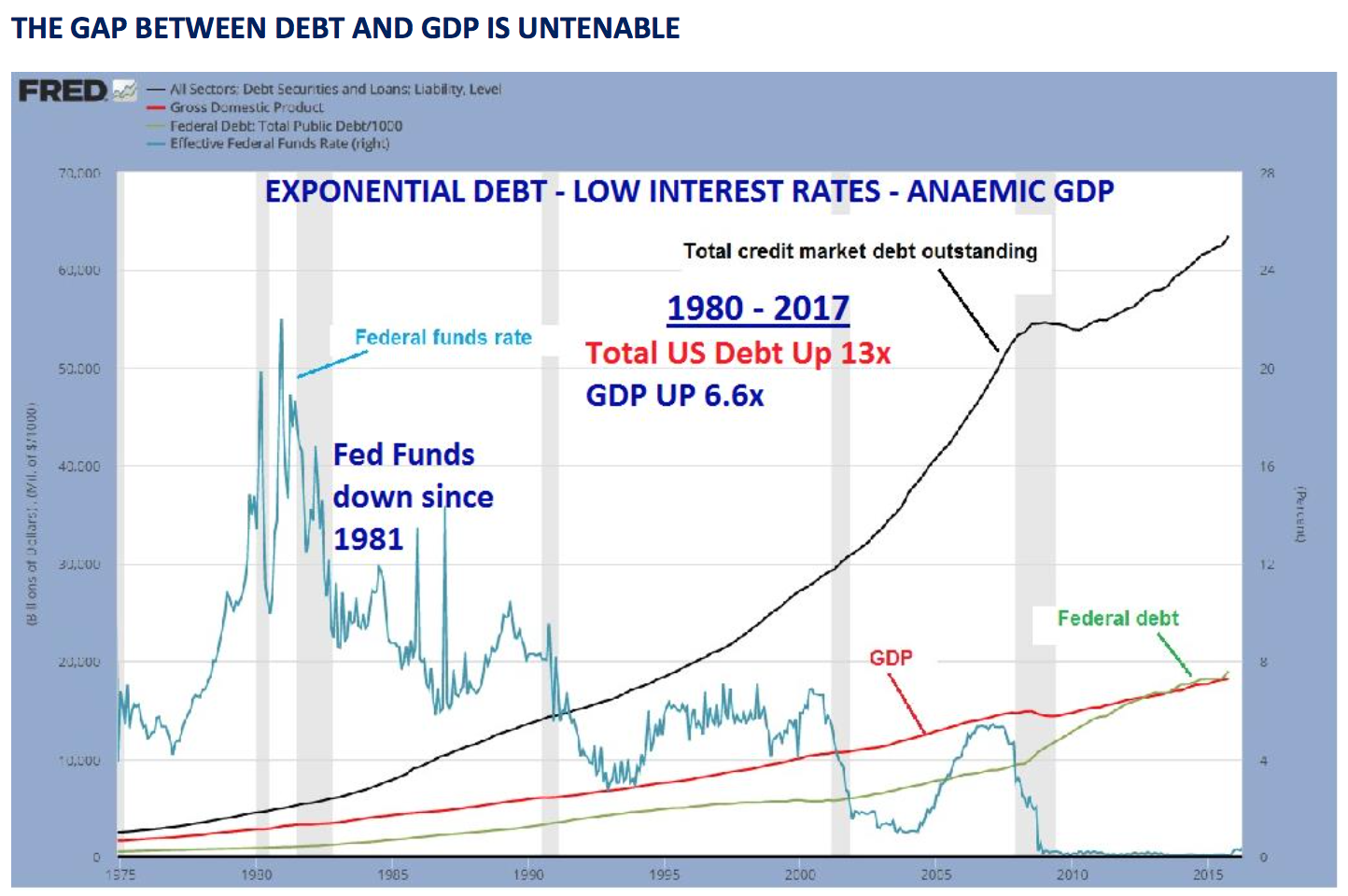

The above graph shows a very ugly picture. The US economic machine is running on empty with debt going up exponentially and GDP slowing down in spite of interest rates at virtually zero. GDP for Q1 2017 is 0.2% annualised. I would not be surprised to see the growth going to zero or negative by Q4. The expanding gap between Total Debt and GDP is extremely dangerous. With GDP needing a continuous injection of stimulants called credit, we know that the patient is on his last leg.

The American economy is now at a point when several dollars of additional credit is required to produce one dollar of GDP. Because of the anaemic state of the US economy, tax cuts, if they are passed, would only increase the deficit without achieving any real growth.

So what can Trump or the Fed do to salvage the situation. Not much! Money printing hasn’t worked, record debts have just temporarily avoided a total collapse of the financial system and interest rates at record lows give very little room to manoeuvre.

The Fed has no policy – Only reacts to events

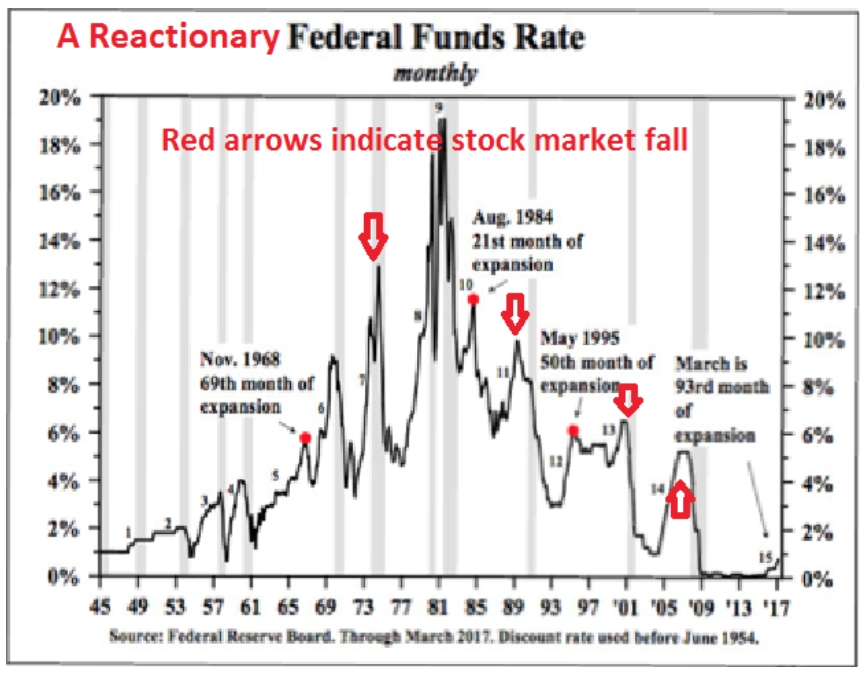

The problem with the Fed is that they have no policy at all. The Fed has never anticipated any economic upturn or downturn. All they do is to react to events. They are always behind the curve. They lower rates after the economy has weakened and they react to events, like stock market downturns.

The graph below gives four examples how the Fed lowers rates as a reaction to a stock market fall. Since 2008, the Fed held rates at zero for 8 years and started raising them too late. The real US economy is now turning down again and the Fed thinks that they can increase rates at least a couple of times this year. Short term it looks more likely that rates will go down.

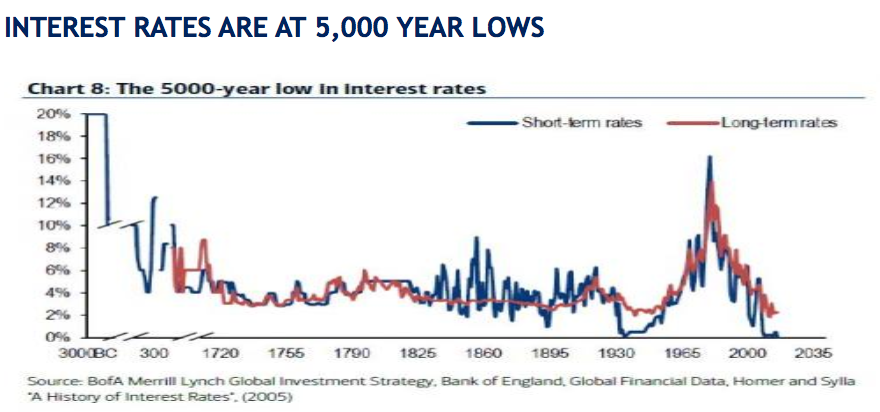

Central banks will lose control of rates

With interest rates at 5,000 year lows, there is only one way that rates can move in the medium to long term, which is up of course. As the financial system comes under pressure in the not too distant future, money printing will resume again and currencies, especially the dollar, will come under pressure. That will lead to the bond bubble bursting with investors selling the long end of the market. As long rates go up, central banks will lose control of short rates leading to high rates across the board. I experienced 15-20% rates in the UK in the 1970s. My first mortgage was at 21% for a while. Not many mortgage borrowers would cope with that today. I am quite convinced that as inflation picks up, rates will be in the teens again or higher, in the next few years. Many rates will reach infinity as bonds become worthless.

Within 5 years most assets will be bought at 90%+ discount – measured in gold

Coming back to the “New Normal”, nobody must believe that the valuations we see in the tech markets today are different to what happened between 2000 and 2002 when the Nasdaq crashed by almost 80% and many tech companies went under. I remember this period particularly well since I was involved with an e-commerce company at the time. At the end of 1999, I told my friend who was the founder that we must sell the company for cash or stocks with no restrictions to sell the stock. Valuations at the time were a crazy 10x sales. None of the companies in the sector made any profit. We managed to sell the business at a good price to a Hong Kong based Nasdaq quoted company. Like many others, the buyer was bankrupt a few years later.

Many Silicon Valley companies are today in a similar situation. Massive valuations, negative cash flows and no profit. In my view, we will have another 2000 collapse but much worse. Also, the big Nasdaq companies are in total bubble land when it comes to valuations. Apple at $770 billion, Google at $648B, Microsoft $533B, Amazon $450B and Facebook at $433B. These five companies are valued at $2.8 trillion. That is twice Russia’s GDP and 42% (71,000 tonnes) of all the gold ever produced. I certainly know what I would prefer. No not Russia, but the gold. Because within five years, the value of these five companies will be down at least 90% against gold which means they can be bought for 6,800 tonnes of gold or less. This massive transfer of wealth that the world will experience in the next few years will come as a massive shock to most investors.

Egon von Greyerz

Founder and Managing Partner

Matterhorn Asset Management AG

goldswitzerland.com

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD