Matthew Piepenburg

Partner Matt began his finance career as a transactional attorney before launching his first hedge fund during the NASDAQ bubble of 1999-2001Thereafter, he began investing his own and other HNW family funds into alternative investment vehicles while operating as a General Counsel, CIO and later Managing Director of a single and multi-family office. Matthew worked closely as well with Morgan Stanley’s hedge fund platform in building a multi-strat/multi-manager fund to better manage risk in a market backdrop of extreme central bank intervention/support. The conviction that precious metals provides the most reliable and longer-term protection against potential systemic risk led Matt to join VON GREYERZ.

The author of the Amazon No#1 Release, Rigged to Fail, Matt is fluent in French, German and English; he is a graduate of Brown (BA), Harvard (MA) and the University of Michigan (JD). Along with Egon von Greyerz, Matthew is the co-author of Gold Matters, which offers an extensive examination of gold as an historically-confirmed wealth-preservation asset.

Insights & Articles

Fatal Macro Warnings: We’re Gonna Need a Bigger Boat

The 2008 crisis (bubble) was limited to real estate; today, we are in an everything bubble, from meme stocks, inflated bonds and over-priced housing to bloated art, over-paid celebrity chefs and pricy...

Matthew Piepenburg / June 7, 2022

Read More

Politisiertes Geld und der Tod des Kapitalismus

Es ist weder ein Geheimnis noch eine große Überraschung, dass unser persönliches Vertrauen in Fiat-Geld (allgemein) und (speziell) Zentralbanker, die dieses Geld entwertet und den Tod des Kapitalismus...

Matthew Piepenburg / June 7, 2022

Read More

ANGRIFF AUF MITTELKLASSE: VW ABSATZ -37,8%

Für Arbeitnehmer auf der ganzen Welt hat die Inflation harte Konsequenzen. Die unsichtbare Steuer ist dabei, den Wohlstand breiter Schichten durch Reallohnverluste aufzuzehren. Verantwortlich sind die...

Matthew Piepenburg / June 5, 2022

Read More

Gold: Patiently Waiting for the Hangover in Global Markets

In this engaging interview with ParadePlatz’s Lukas Heassig, Matterhorn Asset Management principal, Matthew Piepenburg, sits down at MAM’s Zurich office to discuss gold ownership in an increasingly vo...

Matthew Piepenburg / May 30, 2022

Read More

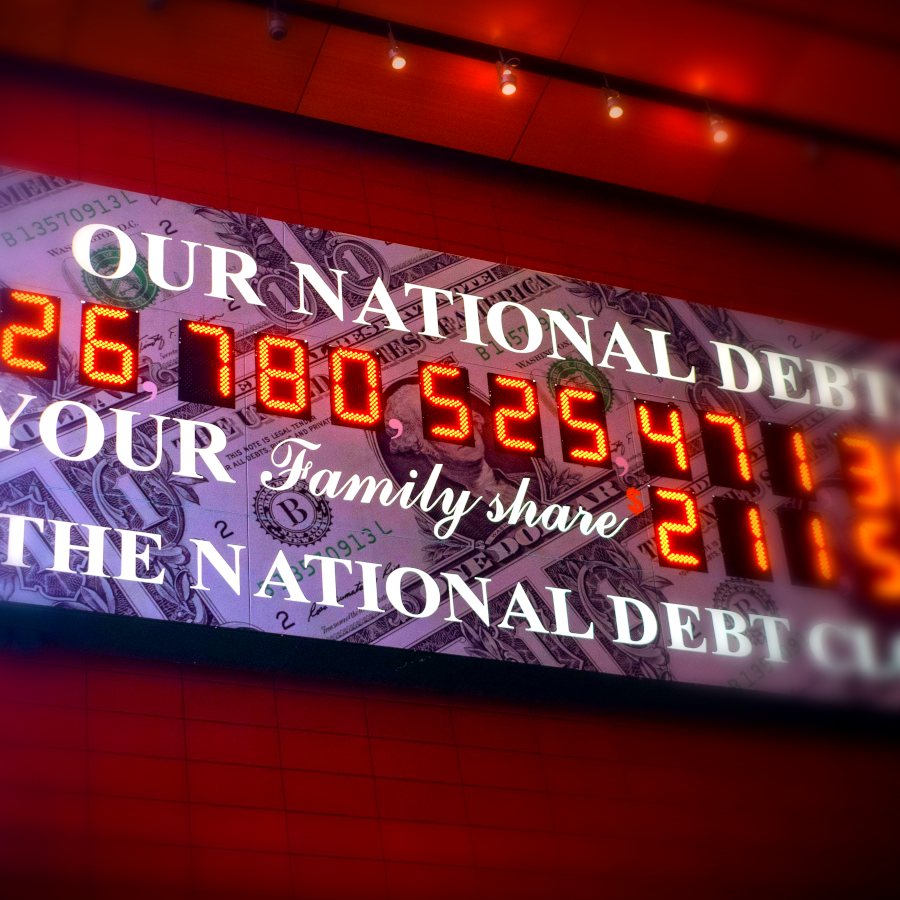

The Handbook for Debt-Soaked Nations: Lie, Print, Inflate & Finger-Point

As we have warned from the very onset of this otherwise avoidable war in Ukraine, the backfiring of Western sanctions against Putin (de-dollarization, inflationary tailwinds and increasingly discredit...

Matthew Piepenburg / May 24, 2022

Read More

Politicized Money and the Death of Capitalism

Everything, including money, is politically-self-serving rather than economically free-market. Capitalism is dead. The folks in office to “save you” are mostly interested in saving their positions and...

Matthew Piepenburg / May 11, 2022

Read More

Dark Forces, Plain Speak, Brighter Gold & The Fed’s Sick End Game

As usual, the end game will boil down to yield curve controls and more money printing, which means more currency debasement and a central bank system that secretly (and historically) favors inflation...

Matthew Piepenburg / April 22, 2022

Read More

Gold vs. An Openly Failing/Changing World

As central bankers play checkers on a global debt chessboard, we see below how policy hypocrisy, worsening monetary options, failed diplomacy, tanking bonds, rising rates, debt addiction, mismanaged s...

Matthew Piepenburg / April 13, 2022

Read More

Sanctions Spur a Massive Decline in Western Hegemony as the World De-Dollarizes

Matthew Piepenburg, sits down with Tom Bodrovics of Palisades Gold Radio to discuss the seismic shifts in the global financial system now emerging in the wake of Russian sanctions and the implications...

Matthew Piepenburg / April 1, 2022

Read More

How the West Was Lost: A Faltering World Reserve Currency

Debt destroys nations, financial systems, markets, and currencies. Always and every time. The inflationary financial system is now failing because its debt levels have rendered it impotent to grow eco...

Matthew Piepenburg / March 30, 2022

Read More