Gold Is The Ultimate Wealth Preservation Against Reckless Governments

Gold Is The Ultimate Wealth Preservation Against Reckless Governments

By Egon von Greyerz

The autumn of 2016 has for some time looked like a period when dark clouds will move in over the world economy. Therefore, it was not surprising to see the first sign of things to come in the next few months. In one day the Dow erased all the gains since early July with an almost 400 point fall. Since the beginning of the year the Dow is now up a pitiful 4%. Almost 8 years of ZERO interest rates have not managed to revive the US economy, nor the world economy. On a longer timeframe the Dow, together with many other markets, looks extremely vulnerable.

Central banks are leading ordinary people to the slaughter

In this century the Dow is up 57% which on the surface appears to be an excellent return over 16 years. But it must be remembered that we have seen an unprecedented period of money printing and credit creation in the last 16 years. In my article last week, I talked about the massive credit creation in the USA. We have seen the same pattern worldwide. China’s debt for example has gone from $1 trillion to $32 trillion in the last 16 years. And Japanese government debt is exploding and has reached 250% of GDP. Japan is now printing half of the government expenditure every month and buying all the bonds that they are issuing. Japan is clearly bankrupt and a default is inevitable. In Europe, the ECB is printing €80 billion every month. But that will of course not suffice to save a bankrupt European financial system. Whether we talk about Greek, Spanish, French, Italian or German banks, their balance sheets are all lumbered with billions of toxic assets with the only buyer being the ECB. This is why the current ECB printing programme will not end in March 2017 but instead accelerate. But as we all know, printed money can never save the financial system. All it will achieve is to increase the debt burden and create hyperinflation.

Clueless investment managers are buying worthless bonds

Negative interest rates in many countries are having no beneficial effect on the world economy. For over $13 trillion of sovereign debt, investors now have to pay governments for the privilege of holding their worthless paper. These clueless investors are not only guaranteed to get less back than they invested due to the negative interest but they are also very unlikely to get the principal back since no government will repay their debt with real money.

As I have stated many times, government bonds is an investment that no one should own. But sadly most institutions and pension funds hold tens of trillions as custodians for the poor investors and pensioners who will see their savings totally evaporate. There has never been a time in history when savings and investments just disappear into a black hole never to return again. But the risk that this will happen in the next five years or so is now greater than any time. The consequences will be devastating.

Real returns in stocks are abyssmal

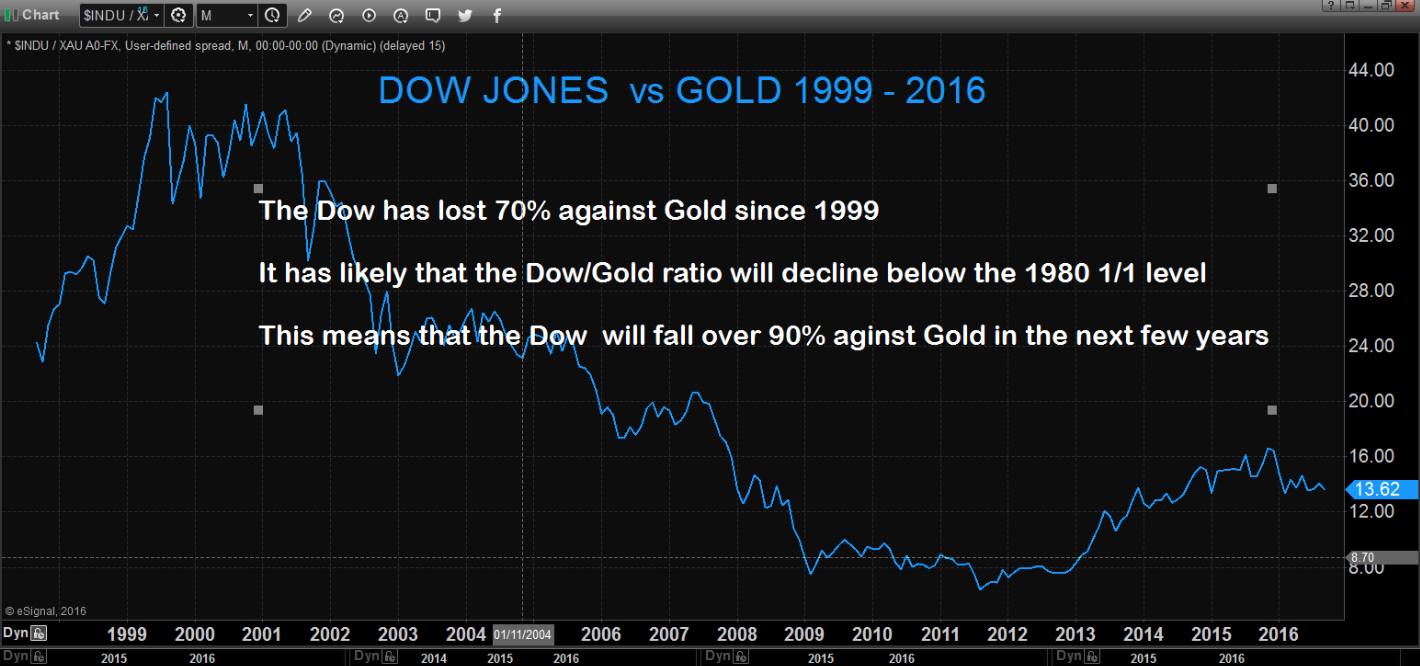

Investors around the world are now facing massive risk in all asset markets be it stocks, bonds or property. The Dow’s rise of 57% since 2000 looks very different if it is compared to constant purchasing power rather than inflated dollars. In real terms, measured against gold, the Dow is down 70% in the last 16 years.

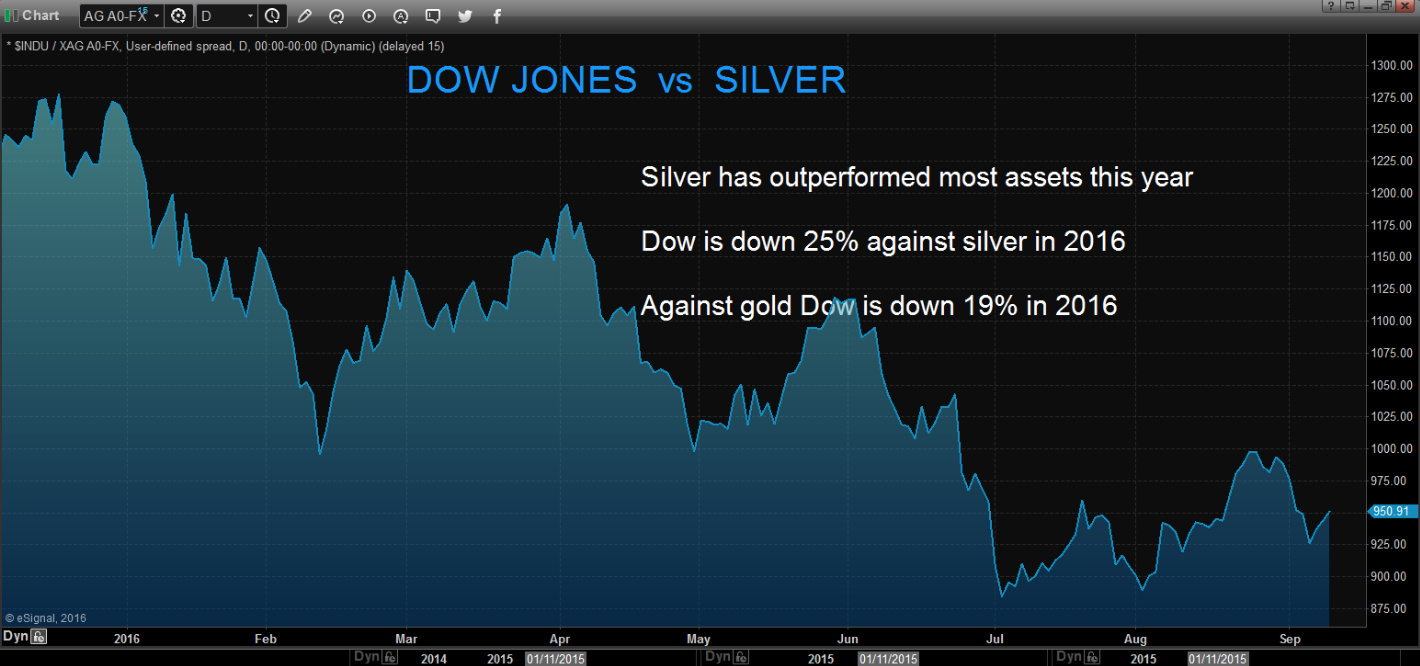

Stock markets worldwide have since the beginning of 2016 underperformed gold and silver substantially. The Dow is down 19% against gold in 2016 and 25% against silver. Silver has been one of the best performing asset classes this year.

But this is likely to be just the beginning of gold and silver’s rise against all other asset markets. Over the next five years I would expect most global stock markets to decline at least 90% against the precious metals.

Gold and silver will be star performers in the next 5+ years

Gold has gone up by 25% this year in dollar terms. The correction in the precious metals that has lasted since 2011 finished in December 2015. Gold and silver have now resumed their uptrend and it is not unlikely that we will see new highs in the next few months above the $1,920 for gold and $50 for silver. In the next few years, gold and silver could easily reach $10,000 and $500 respectively. The gold silver ration could even go to 10 as John Embry and I discussed recently. That would give us a silver price of $1,000. But before the coming money printing bonanza by central banks has finished, we could see multiples of those targets in a hyperinflationary collapse of paper money values.

So today is still an excellent time to buy gold and silver, but I doubt that we will see these prices for much longer.

Don’t buy gold or silver that will never be yours

When precious metals are bought for wealth preservation purposes, certain cardinal rules must be followed.

The following methods to acquire/hold gold and silver is NOT wealth preservation and must therefore be avoided at all costs:

- Gold and silver ETFs – Most ETFs are not backed by physical metals even if they indicate they are. If you read the prospectuses properly, you will find that even the gold/silver backed ETFs can hold paper metals instead. Also ETFs are in effect a paper investment within the financial system that investors are unlikely to get possession of in case of a default.

- Futures and bank paper gold/silver – These must also be avoided since they are just paper claims that will never be settled in case of a crisis.

- Gold/silver stored in a bank – We have seen numerous examples of clients being told they have allocated gold/silver bars when in fact the bank doesn’t have the metals. And even if the bank does hold physical metals for the clients, in times of crisis we have often seen examples of banks using client assets. Storing in a private bank safe deposit box is not advisable either since in case of bank failure, investors might not get access for a very long time.

- Part ownership of gold/silver bars – Many companies offer shared part ownership of metals stored outside the banking system. With this method, the investor does not own his own

allocated bar and does not have personal access to his metals. - Storing gold/silver at home – You should only store the amount of metals at home that you

can afford to lose. Increasing crime and social unrest will make home storage very dangerous and often family members could be threatened at gun point to reveal a hiding place.

This is real wealth preservation:

- Hold your gold/silver in allocated physical form in private vaults outside the banking system.

- You must have direct ownership and control of your individual bars/coins.

- You must have total control and access to your metals and eliminate counterparty risk.

- Your metals must be insured.

- Store your metals in a politically safe country, preferably outside your country of residence.

- Buy metals directly from recognised refiners. Forgeries are now prevalent.

Many investors ask what percentage of their financial assets should be in precious metals. Some investors who are really concerned about the financial system have 60-100% in gold together with some silver. Investors must themselves decide what percentage they feel comfortable with. In our view the investment in metals should be sufficient to fall back on if there is a crisis in the financial system which prevents access to other investments or makes it impossible to raise cash from other assets.

What is important to remember is that gold and silver is money and instant liquidity. Throughout history, in every country where there has been a serious financial crisis, gold and silver have always functioned as money or barter.

Egon von Greyerz

Founder and Managing Partner

Matterhorn Asset Management AG

matterhorn.gold

goldswitzerland.com

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD