Market Forces Will Destroy Central Banks – Marc Faber

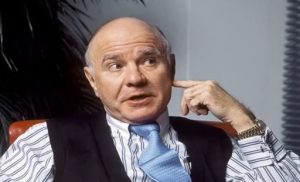

THE MATTERHORN INTERVIEW – 1 September, 2013: Marc Faber

“The Market Forces Will Destroy Central Banks”

In this conversation for Matterhorn Asset Management, financial journalist Lars Schall talked with internationally known investment advisor/fund manager Marc Faber about, inter alia: the main beneficiaries of the current monetary policies undertaken by central banks around the globe; the Fed’s tapering; why Faber does still believe in gold; and his bullish view on crude oil.

Dr. Marc Faber was born in Zurich, Switzerland. He studied Economics at the University of Zurich and obtained a PhD in Economics magna cum laude. Between 1970 and 1978, Dr Faber worked for White Weld & Company Limited in New York, Zurich and Hong Kong. Since 1973, he has lived in Hong Kong. From 1978 to 1990, he was the Managing Director of Drexel Burnham Lambert (HK) Ltd.

In June 1990, he set up his own advisory and fund management firm, Marc Faber Limited. Marc is also on the board of Sprott Asset Management.

He publishes the monthly investment newsletter “The Gloom Boom & Doom Report,” an in depth economic and financial publication, which highlights unusual investment opportunities around the world. Moreover, he is the author of several books including “ Tomorrow’s Gold: Asia’s Age of Discovery,” which was first published in 2002, and is also a regular contributor to several leading financial publications around the world.

Dr. Faber, what do you think is the most important question in our days in the world of finance that is rarely raised?

M.F.: Well I think we have unprecedented government interventions with fiscal and monetary policies. For me it’s not really a question, it won’t work but miracles do happen, and maybe based on the bailouts and huge monetary inflation that the central bankers have created, maybe it is possible that the financial system heals and that the global economy resumes a, say, trend line growth such that we had in the 90’s and the early parts in 2000 and 2005. But I very much doubt that.

L.S.: Who are the main beneficiaries?

M.F.: That’s pretty much a philosophical question whether the intervention by the government will have a long-term positive or rather negative impact on the global economy.

L.S.: Yes, but who are the main beneficiaries of the current monetary policies undertaken by central banks around the globe?

M.F.: Very clearly – and this was already observed by Copernicus and later by David Hume and Adam Smith and also Irving Fisher – when you change money, when you have essentially an increase in the balance sheet of central banks and an increase in the quantity of money, the problem is that the money doesn’t flow evenly into the system but it flows into some sectors at different times and it creates booms in some sectors of the economy.

The major beneficiaries of the most recent monetary inflation based in 2008 have been people closest to the source of the liquidity. In other words the financial sector, hedge fund and bond managers, private equity firms and large asset holders; because if you look at, say, who owns shares in the U.S.; the majority of people have no shareholding to speak of. It’s the minority, maybe five percent of the population, that holds the majority of shares. So the money printing has actually been very beneficial to well-to-do people.

That’s why some high-end property prices are at record highs. It’s been also beneficial to people with money in emerging economies because a lot of funds flow into emerging economies due to the huge U.S. trade and current account deficits and it has been rather detrimental to the middle class and the working class because their costs of living have risen more than their wages.

L.S.: What could be done to solve a systemic crisis?

M.F.: Recently, there was a professor in Germany who argued that the problem are the well-to-do people and that they should be taxed, very heavily penalized and that part of their assets should be taken away. I don’t think that the well-to-do people per se are the problem. I think the money trading by central banks is the problem and the expected debt growth, credit growth by governments and also on the household sector level and the unfunded liability. So, essentially, one of the solutions to the problem – and there is not going to be a solution that is not very painful – there will be pain and people will have to cut back on their consumption and also review their future benefits from pension funds and from social security, health care and so forth and so on.

We’ve lived beyond our means in most countries and to solve that problem is not going to be without significant pain. But effecting the right direction would be to take the depression away from central bankers to increase and cut the money supply and to intervene into the free market essentially with monetary measures. I think that would be the first step in the right direction because if you look at what has happened in the economy, one of the safest goals of central banks is price stability. Well where has there been price stability over the last 15 years? We had a colossal NASDAQ problem and then a collapse and then a colossal credit bubble and housing bubble and then a collapse and then we had a colossal bubble in commodities in 2008 when the oil price went to 147 Dollars, and so if the goal is price stability, basically the fiscal and in particular the monetary interventions have actually led to more instability rather than stability.

L.S.: Are the financial elites interested in solutions at all according to your experience?

M.F.: I would say basically we have democracies but it should be clear to anyone who lives in Western Europe or in the U.S. that the individual on paper he has plenty of rights but in reality he can be stopped by an authority at the airport and kept in custody for a day or two and harassed and so forth and so on. So his rights are actually very limited. And we have today governments in Brussels and also in Germany and in Switzerland, basically everywhere, where they do not represent the will of the people. In other words they don’t care about the people. They care about themselves.

We have a government bureaucracy class that essentially pursues its own interests and within that class you have the treasury department and you have the central banks. The thing is, I know quite a few members and former members of the Fed, this is an institution, it’s a club of, say on paper, educated people but with no business experience. They are not familiar with the problems of the businessmen and they have developed group thinking. All of them are money traders.

Now, some are maybe larger money traders like Eric Rosengren of Boston Fed or Yellen, and some are maybe less money traders. Basically they all trade money or intervene with monetary measures if the economy slows down or has a recession, a recession of degree. And my sense is that the government and the central bank will not solve the problem of central banks, only a major crisis that completely discredits the central bankers and the banking system will solve the problem.

L.S.: While you’re bearish when it comes to the stock market in general, you seem to be optimistic with regards to gold mining shares. Why so?

M.F.: Well, basically the U.S. market is in the sky, we have a very strong outperformance of U.S. stock vis-à-vis Europe until a year ago and vis-à-vis emerging markets until now. But the European economies are a large portion of the U.S. corporate earnings, but they’re not growing. The U.S. is hardly growing. Growth came from emerging markets and these emerging economies are essentially today in a no-growth environment. I live in Asia, so I am quite familiar on my observations on the ground. We have no recession that is visible. It is often seen like a pain. But we’re just at the high level of economic activity; no longer growing.

So in my view, the earnings of multinationals will disappoint, and don’t forget, we had this huge increase, it integrates on a percentage rise. The 10-year Treasury note has now gone up from July 2012, from 1.43% to now 2.88. So we have essentially doubled in yield. This is remarkable, especially in view of the fact that in September 2012 Mr. Bernanke said, the purpose of QE 3, which then became QE 4, is to lower interest rates. So the safest goal of the Fed has badly expired in the sense that interest rates are up essentially, and not down. That is for the first time in many years that the market forces are more powerful than the central bank action. And so the U.S. market is high, relative to other markets.

There’s no earning growth to speak of at the present time. There has been a lot of speculation and evaluations are relatively stretched. So, I don’t think that U.S. stocks offer great value and that they could easily drop. 20, 30 percent wouldn’t surprise me at all. Gold shares are in a different position because they’ve been correcting essentially since 2011 and many gold shares are down 50 percent from those highs. So like emerging stock markets they have grossly underperformed the overall indices in the U.S. and with all the money printing – and I have to point out, I don’t believe in any tapering – maybe they reduce asset purchases somewhat, but I think it’s actually quite likely that they will increase asset purchases. For the simple reason that the economy doesn’t recover, stock market goes down, the bond market goes down, and then the people at the Fed will say, we didn’t do enough. And then they will go and increase their asset purchase. Including the Fed in theory would buy you off the stock markets. So I think that in this environment of money printing you want to own some physical gold held outside the U.S. I don’t understand why it would take eight years for the U.S. to deliver the gold. The German Bundesbank would be possible to do it in one week, but maybe the gold is not there.

L.S.: Yes.

M.F.: All I want to say, I would hold physical gold. Preferably probably in Singapore, Hong Kong or other Asian countries. And gold shares are a trading opportunity because they’re so oversold and along with the performance of gold prices they should re-bounce quite strongly.

L.S.: Since you already mentioned it, besides the repatriation of some of the German Gold from the New York Fed and the Banque de France, the Bundesbank will leave a huge amount of its gold in New York City and London to have in the event of a currency crisis the ability to exchange gold for foreign currency within a short space of time – does this argument convince you?

M.F.: No, because that’s complete nonsense, because if the gold would be held in Germany, in a vault, and if there was a financial panic and they really needed to draw loans against the gold that they hold in Germany, they could obtain loans at any time from a bank or from another central bank or whatever it is. So they could have the gold in Germany and if they wish to obtain a large loan against those gold reserves and they wouldn’t be that much anyway, but if they wanted to obtain a loan, they could have an auditor come and check the gold and then a bank or a central bank would essentially lend them money against that gold. All I want to say is, something is fishy about the gold market in the sense that if the Germans demand to have a part of the gold received in Germany, I think it would take eight years, we should put gold on three Boeings 747’s and you ship it to Germany and that’s it.

L.S.: Yes. What things have to be in place before you talk about a bubble in gold?

M.F.: Well, I lived through the bubble in gold in the 1970’s and by 1979, November, the gold price was around 450 Dollars and within three months it went up to 850 Dollars, so within three months, actually two months, November, December and early January, we made it big. It went up almost 50 percent. So a bubble usually characterized by a terminal upwards move in these real estate or gold or stocks or collectables that is almost vertical. In other words, an acceleration on the upside. And that hasn’t happened yet.

Moreover, one of the symptoms of a bubble is widespread public market invasion, in other words most people are one way or the other involved in the market, in real estate, like in the U.S. in 2007 or in NASDAQ stocks in 2000 or on other … Or in the 70’s, in the 70’s, when I was running Drexel Burnham at that time, our office was like a casino; people came in to trade gold 24 hours a day. That doesn’t happen today.

Okay, we have now better communication so we have the internet on which you can place orders through the internet and through phones and others but if I go to conferences and I talk about investments, I frequently ask the audience, how many of you own gold and how many have, say more than five percent of your assets in gold? Most, I mean, if at most three to five percent of the audience owns any gold, that’s about it. So where, say 12 years ago, if I had asked, who of you owns NASDAQ stocks, maybe 80 percent would have said, yes. So based on the ownership of gold from financial institutions and also based on the public participation, I don’t think we’re in a bubble.

L.S.: In turn would you say that gold is still cheap?

M.F.: Well, the problem with zero interest rate policies and money printing is that it distorts all evaluation models, it’s very difficult to value something. I could say, okay, this house in Mayfair or on Park Avenue or Madison Avenue in New York is expensive if I compare it to, say a quantity of money that’s been floating around the world, but maybe it isn’t. Is a Warhol painting expensive or cheap? Well it’s up, say 12 times over the last ten years, so it’s gone up a lot but the quantity of money has also gone up a lot and the number of billionaires around the world has also expanded and so forth and so on. So I can say, maybe gold relative to a Warhol painting or relative to the U.S. stock market is not that expensive or relative to Hampton property. Obviously those are up from 250 Dollars in 1999 to now over 1.300, so, expensive or cheap is a very difficult concept in the present environment.

L.S.: Yes, I agree.

M.F.: I think all the investors should consider, what is actually the downside. Say you have a billion Dollars; under normal conditions maybe the safest is to keep everything in cash. Now because under normal conditions, say little inflation and the purchasing power of money is maintained, the banking system is down. So you keep it in cash. But under the present condition, cash could be very dangerous, say if banks had another bailout, I think that the public opinion would shift to penalizing large depositors. In other words, if you have 100.000 Dollars on deposit with Deutsche Bank, maybe you get your money back but if you have a billion Dollars, maybe they take the haircut of 50 percent. So in this environment you can ask yourself if you have a billion Dollars. Well, what is relatively safe? So I would imagine that real estate is relatively safe because it’s widely owned by a large portion of the population. It may go down in value and it may be taxed away but it’s feasibly safe. If you look at Germany in 1928, the large and the more stable companies from Siemens to whatever it is, say, BASF, they survived. And so you were better off in stocks in the long run to wars and hyperinflation than in cash and bonds. When you look at gold, well, gold is very safe. It often has a high return in the long run, per se based provided and this is the proviso, the governments don’t take it away. That is a big issue.

L.S.: What are your thoughts on China’s gold policy?

M.F.: Basically, the Chinese are encouraging Chinese people to own gold and the government has probably been a heavy buyer of gold because China is probably the world’s largest producer. So they buy the gold maybe directly from their own mines and it’s obviously a source of demand. That’s why it’s interesting that the price of gold fell so sharply from 1.921 Dollars in September 2011 to below 1.200 when actually the physical demand was relatively high.

L.S.: Yes. Do you think so that the dominant factor in the West regarding gold is the paper gold market?

M.F.: Well, I don’t know. There are lots of theories about manipulation in the gold market. I always say, this doesn’t concern me, and I hope that the central banks manipulate the price down because if that is the case – don’t forget that every manipulation eventually leads to a move in the opposite direction that is very violent – so in other words, if someone manipulates the price down, in my view eventually the price will shoot up very dramatically. It’s like if you have wage control, eventually the wage control falls apart and wages go through the roof. Similarly if you have in the commodities market price support like coffee or oil or what not, eventually the price falls through the price support and so forth and so on. Market force is always more powerful, so I hope the gold price was manipulated down because then it will go through the roof eventually.

L.S.: Yes. What do you see as the main challenges for China going forward?

M.F.: Well I mean there are many challenges. Basically they have a misallocation of resources, they have a credit growth, there’s a lot of (expected?) capacities in some industries. And that present time the economy, in my view and based on some corporate results, it would appear that the economy is hardly growing. So, this very strong growth we had in the last say 10, 20 years is going to slow down regardless, to a range in my view of between four to six percent. If you’re lucky they grow at that rate. But the question is, from this ten-percent growth rate plus minus to say your range to four to six percent is that transition going to be a smooth transition or interrupted by some kind of a crisis? I think some kind of a crisis scenario quite likely.

L.S.: You think that investing in crude oil is very attractive among commodities. Why so?

M.F.: Well, we have to break that commodities into soft, into grains, into essentially industrial commodities, precious metals and so forth and so on. Life stock also … And they move in general in the similar direction but maybe at different times. Now, say if the price of corn goes up substantially, the farmers can right away increase the production of corn and a year later the additional supplies will then essentially contain further price increase and the price will go down. In the case of the oil industry and also for copper, once you have shortages developing, until new large reserves come on stream and until new mines essentially produce, the response time is very long and we have essentially in the world, coming from emerging economies – those would be China and India – very rapidly rising oil demands.

In other words in China over the last 15 years, oil imports, they have risen three times. Yes, China consumes now almost ten million barrels of oil a day. So the demand is there, if they slow down somewhat, long-term it’s there. Every oil well eventually runs dry. It cannot produce forever. New oil is very costly to produce. In other words you have to go and drill and you have to then extract the oil and there’s a lot of safety regulations and and and. Very costly, probably around 80 Dollars a barrel. And we have this Middle Eastern situation about which I am extremely negative. I think the whole Middle East will blow up. So, as a commodity I think oil is reasonably attractive and I would not rule out that the price could break out on the upside, I would rather be long on oil than short.

L.S.: Do you think that gold will become a prime form of money in international trade for example in exchange for energy and natural resources? Is it possible for example, that where foreign creditors unwilling to accept Dollars or Euros for their exports, but rather began demanding the balance of payments be settled in gold, that this would force the Fed and ECB to reform accordingly? Would this perhaps lead the world back onto some form of gold standard? And if so, would this be desirable at all in your view?

M.F.: Well, I don’t think that this will happen in the near future, but say, if we continue printing money and we go into kind of a hyperinflation environment, then obviously people will prize their goods not in paper money because, you know, in a hyperinflation environment, paper money looses value by the day, so nobody wants to hold cash. So in that environment it will make index things gold. That is a possibility.

But I rather think, what will eventually happen is that the market forces will destroy central banks. It’s actually interesting, based on the losses that the Federal Reserve already has, they have now negative equity. Of course they don’t go bankrupt because they can basically print money – but it is where the commercial enterprises would be bankrupt. I believe one day the financial system including derivatives, whole leverage and so forth, will go up in the air and then voices will come up and say, well who actually created this whole mess and at that point the central bankers and Mr. Bernanke say well, he is the John Law of the 21st century.

And then I think we will go back, probably to some kind of an agreement between countries whereby gold plays a role. We never had a fewer gold standard in the sense that there was only gold used to transact. You always had gold, but also the paper money, in 19th century also. But paper money had the linkage to gold. And I think we will go back to that system eventually.

L.S.: Thank you very much for your time, Dr. Faber!

About Edward Maas

Edward Maas

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD