THE DEATH OF LOGIC

Just over four years ago, as Bitcoin was making its first big moves in both price and public perception, John Hussman of Hussman Investment Trust penned a lengthy as well as seminal report entitled, “Three Delusions: Paper Wealth, a Booming Economy, and Bitcoin.”

The core themes set forth in his report (as in any well-reasoned, blunt analysis) are refreshingly evergreen in their ongoing applicability.

Rather than re-invent an already functioning wheel, I’ve opted to revisit some of Hussman’s key arguments which have not only stood the test of time, but remain even more pertinent in today’s perception-challenged markets.

The Follies of Our Predecessors

Hussman’s report opens with a quote from Charles Mackay’s work, Extraordinary Popular Delusions and the Madness of Crowds:

“Let us not, in the pride of our superior knowledge, turn with contempt from the follies of our predecessors. The Study of the errors into which great minds have fallen in the pursuit of truth can never be uninstructive.”

As for the “follies of our predecessors” and “the study of [their] errors,” the list is long and distinguished, as we’ve chronicled in greater detail elsewhere, advising investors to question rather than follow the “experts”while simultaneously keeping a cautious eye onthe madness of crowds.

As Hussman and others remind, delusion is a complicated thing.

Most logical minds, for example, tend to feel immune from delusion, but the irony lies in the fact that delusional ideas, including delusional markets, policies and pricing, are in fact marked not by deficiencies in logic, but rather by an over-abundance of it.

Crowd Thinking—Crowd “Logic”?

Throughout the cyclical history of delusional market bubbles and their subsequent implosions, otherwise “logical” and/or intelligent market participants always find themselves in the comforting presence of crowds.

In Japan, for example, just before the Nikkei died in 1989, the popular expression in Tokyo was: “How can we get hurt if we’re all crossing the street at the same time?”

Crowds, of course, love comforting consensus, feedback loops and opportunism, often at the expense of historical lessons, ignored data or even common sense.

Instead, crowds focus on current signals, lofty credentials and the loud logic of price momentum at the expense of risk’s more unpleasant whispers.

In other words, logical minds will often overlook unpleasant information and cling exclusively to the data which confirms their hopes and biases, creating a mass perception that is often misperception.

As Hussman observed: “The reason that delusions are so hard to fight with logic is that delusions themselves are established through the exercise of logic.”

The overwhelming and objective evidence, for example, of dangerous and grossly distorted risk asset pricing can be easily re-described (and thus re-perceived and re-framed) in the echo chambers of bubble-blind investors or debt-cornered policy makers as logical “stimulus,” “support,” or “accommodation.”

The logic that Modern Monetary Theory, for example, with its academic aura and blissful projections of deficits without tears (and money creation sans inflation) has slowly left the fringe of economics and entered its forefront as a sound, indeed “logical” new path forward.

Equally, “logical” are the titles given to such popular policies as “Yield Curve Control” or “Quantitative Easing,” which, as many of us already understand, are just clever, even logically titled concepts masking the far more pernicious reality of extreme debt expansion supported by extreme money creation which leads logically to extreme currency debasement.

Indeed, these crowd-sanctioned ideas have acquired popular/global acceptance not because they are logical or rational, but simply because they have become crowd-acceptable, common and, at least for now, profitable and even “effective.”

History’s Patterns

For Hussman, as well as other students of market history, speculative bubbles or even mass psychology, such delusions of popularity, logic, profit and even efficiency are not only dangerous, but historically quite common.

His lengthy report traces the anatomy of prior bubbles and crowd-ignored delusions with painful candor and historical confirmation rather than just self-selecting logic.

His insights are highly, highly recommended.

The conclusions which Hussman and others (from J.K. Galbraith to Benjamin Graham) derived come down to this:

Deluded investors forever seek to justify extreme price valuations in ever-increasing and novel ways, which in the end, are nothing “but excuses for continued speculation” rather than honest confessions of desperate top creations and equally delusional top chasing.

Hussman takes particular care to point out that such delusions are not simply held by retail investors riding a speculative wave which will eventually drown them.

The “Experts”—A Smaller Yet Equally Mad Crowd

In fact, the so-called experts, like Janet Yellen in Hussman’s study, are equally, if not more, guilty of such self-delusion.

Of course, this is no surprise to many of us.

Hundreds of pages could be written which detail the myriad occasions in which Yellen, both before and after she took the Chair at the Federal Reserve, completely understated, exacerbated and then ignored real market risk, from the Pre-08 era to today.

For simplicity and brevity, let me just proffer the following example:

“You will never see another financial crisis in your lifetime.”

-Janet Yellen, spring 2018

“I do worry that we could have another financial crisis. ″

-Janet Yellen, fall 2018

Valuation Still Matters

What Hussman and countless other logical minds consistently warn boils down to a simple truth proven throughout history, from the Romans of old to the Elons of today, namely: Valuation still matters.

First published in December of 2017, Hussman’s report warned that the expert as well as investor-fed speculative bubble in full gear then would inevitably devolve “into a roughly -65% loss in the S&P over the completion of the current market cycle.”

Of course, logical detractors would laugh at such logic, reminding Hussman and others that such warnings, made over four years prior, have been disproved by an S&P that never seems to halt its climb north, despite a few hiccups along the way, easily “recovered” by more logical Fed “support.”

Such “logic” however, misses the historical point that boom-to-bust cycles don’t have clearly defined expiration dates, especially when those natural cycles are un-naturally extended via equally un-natural and illogical “stimulus” from global central banks.

Preparing Rather than Timing the Death of Paper “Wealth”

Thus, rather than mire one’s self in the “logical” debate of timing a crisis (a fool’s errand), more informed, and hence logical minds, should be otherwise engaged in preparing for one.

Hussman’s lengthy report then turns to the ultimate delusion, namely the delusion of paper wealth.

He began this theme with a quote by Galbraith as to the “extreme brevity of the financial memory.”

At the time of its 2017 publication, Hussman’s report referenced the St. Louis Fed’s December 16th declaration that negative interest rates “may seem ludicrous, but not if they succeed in pushing people to invest in something more stimulating to the economy than government bonds.”

Hussman was prescient in not only proving that “expert logic” can be openly delusional, but also in how predictively the mad crowds would follow such expert delusion toward even greater speculation, greater bubbles, and alas, greater pain when they pop.

As for the so-called logic of the St. Louis Fed in its stance as to negative rates “succeeding” in pushing crowds to invest in something “more stimulating” to our economy, history and Hussman prove, yet again, how dangerous experts can become in their own illogical crowd.

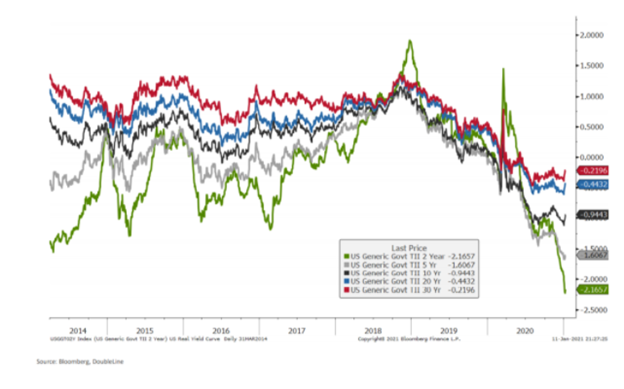

As for those ludicrous yet real negative rates, well, we sure as Hell got em post 2017…

Fast forward just over four years since the Fed made this so-called “logical” suggestion and look at what those low rates and retail “people” have invested in since.

Take Tesla.

It’s a bubble asset for the ages, and whatever logical defense Tesla bulls might have for its “growth potential,” the screaming disconnect between its cash flow and share price once again proves Hussman’s warning that valuation still matters.

Once assets climb too far from the plow of real valuation, the end is not only brutal, but inevitable.

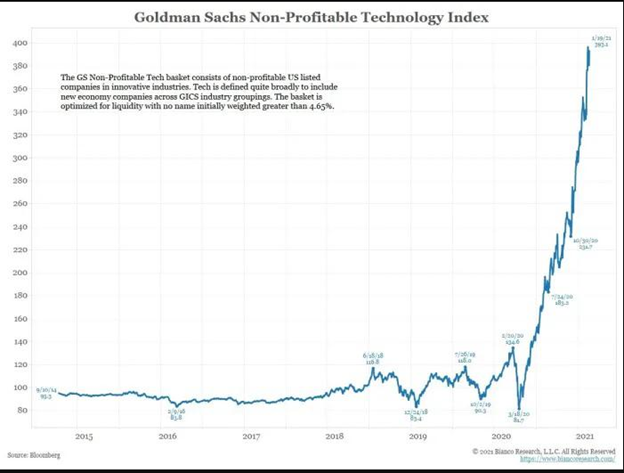

Similar and “logical” (?) speculation suggested by the St. Louis Fed has taken place since 2017, but as the graph below of profitless IPO’s currently peddled by the “logical crowd” at Goldman Sachs confirm, none of that speculation was as economically logical or “successful” as our Fed “experts” had so arrogantly suggested in late 2017:

When stocks rise illogically on the backs of speculative (QE/debt-driven) policies which in fact have no logic despite the credentialed “logic” of their policy makers, the paper wealth which follows and grows in their wake acquire the delusion of permanence, even stability.

But as Hussman warned then, and which is even more true today, investors quickly and collectively fall under the collective delusion that the trillions of dollars in their portfolios today represent durable purchasing power tomorrow.

In other words, “logical” investors always ignore the historically confirmed fact that most of that wealth will eventually evaporate in a delusional economy measured by rising stock prices rather than tanking productivity.

Today, for example, the global value of financial assets (stocks, bonds and real estate) is $520 trillion, which is 6.2X the $84 trillion in global GDP.

Re-read that last line. Seem delusional to you?

And Then There’s Bitcoin…

Speaking of delusion, no conversation then (in 2017) or today, would be complete without addressing the current, yet logically-defended sacred cow otherwise known as Bitcoin.

This is not the time or word-count space to effectively unpack the myriad pros and cons, as well as logic and delusion, which mark the Bitcoin phenomenon.

But as Mackay was quoted then, and worth repeating here, such speculative cycles are not only common, but loaded with historical danger:

“We find that whole communities suddenly fix their minds upon one object, and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught in some new folly more captivating than the first.”

Sound eerily familiar?

From 17th century tulips to 19th century railroads or 20th century tech stocks, market historians know this fantasy pattern all too well.

Of course, Bitcoin is more than a tulip, and as Hussman himself confirmed, “the blockchain algorithm itself is brilliant.”

I too fully support Bitcoin’s underlying thesis that fiat currencies and the central bank policies behind them are staggeringly weak and in need of an alternative approach.

But the irony, as well as delusion, of the BTC era boils down to this: No asset bubble like Bitcoin, despite the logic of its thesis or the headline-generated confirmation of its supporters (as well as mysterious creators) can become a source of stability for something as critical as a national or global currency.

Bitcoin will not go away, but its valuations will go both north and south in astounding ways which, by itself, disqualifies this asset as a rational (or even “logical”) solution to an admittedly irrational and openly bogus global currency market.

Our antidote to the dying paper wealth of all global paper currencies, of course is physical gold. This is no secret, and to some, perhaps even an illogical, and even outdated bias.

Yes, physical gold is far less sexy that the current BTC delusion gaining popularity, as well as speculative momentum, by the day.

Ironically, however, therein lies gold’s open and logical advantage, for physical gold, unlike electronic Bitcoin, has both an inherent as well as historical logic to both its role (and pricing) when measured against fiat paper as well as equally fiat digital “coins,” which logically speaking, aren’t even coins at all…

Like dollars, Bitcoins are backed by faith, not a physical asset. In short: fiat.

Detractors, of course will claim that the Hussman logic used to debunk BTC’s speculative illogic (i.e. delusion) can be equally used against the logic to defend physical gold.

This is both fair and to be expected.

In the end, however, to describe a physical asset derived from the periodic table (rather than a software genius) and which has historically served to save dying currencies and delusional debt policies century, after century, and currency crash after currency crash, as a “delusion” is a bit of a stretch, no?

Bitcoin cheerleaders will naturally, in their own crowd-supported logic, argue that physical gold is the “Blockbuster video” of an old world, whereas BTC is the streaming and wise currency direction of the new world.

That’s a comforting defense indeed, as are the rapidly rising valuations of BTC.

But like Hussman, I’ll favor valuation, sanity, history and valuation logic over the mad crowds falling madly in love with the speculative “logic” of BTC.

In the end, history favors one form of logic over the other.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD