What is Key for the price formation of Gold?

THE MATTERHORN INTERVIEW – Jan 2013: Robert Blumen

“What’s really key for the price formation of gold?”

In this exclusive interview for Matterhorn Asset Management, Robert Blumen discusses some important but widely misunderstood elements acting on the gold price. He explains that frequently cited gold demand statistics have no relationship to the gold price. In addition, he explains that the annual gold mine production is of very little influence, as gold is hoarded, not consumed like other commodities.

By Lars Schall

Robert Blumen was born in 1964 and grew up in Boulder, Colorado, United States. He is a graduate of Stanford University in physics and the University of California Berkeley in engineering. He lives in San Francisco, United States where he works in the technology sector as a software engineer, specializing in server applications and the architecture of scalable systems. He has maintained a lifelong interest in the Austrian School of Economic Thought and is an avid reader in economics and finance. His writings on gold and a variety of economic topics have been published by Financial Sense, the Ludwig von Mises Institute, LewRockwell.com, The Dollar Vigilante, and Marc Faber’s Gloom Boom and Doom letter as well as other gold and financial sites.

Lars Schall: Mr. Blumen, how did you become interested in the subject of gold in general?

Robert Blumen: There were two main influences when I was growing up in the 1970s and 80s. We went through a period of very high inflation in the United States. President Nixon imposed wage and price controls in a misguided, or perhaps very cynical, attempt to fight inflation. And Nixon’s successor, President Ford, handed out these silly little lapel buttons that said “Whip Inflation Now”. I remember seeing a young man on the TV news who had reported a chain store for the economic crime of raising the price of one of their products. He was being given some kind of award for this.

The second historical event was the gold bull market of the late 70s. Then Reagan came in along with Paul Volker who he inherited from the former president, Carter. I wasn’t paying much attention at the time but it stuck with me that gold had made this huge move.

Those two things came together and had a life-long influence on me. From that time I took away a curiosity about inflation. And that led me eventually to be curious about the whole field of economics. I was lucky that I came upon the Austrian School of Economics. I started reading Austrian economics in high school. The Austrian School emphasized gold as the basis of the monetary system and how well that has worked out over the course of human history.

L.S.: The growing interest in gold was underlined recently in a report that was published by the Official Monetary and Financial Institutions Forum (OMFIF), which has the title “Gold, the renminbi and the multi-currency reserve system“. (1) I think that this report is quite remarkable for various reasons. Do you agree?

R.B.: The report suggests that the international monetary system will accept gold in a more recognized way as a reserve asset. I think that this is already true, informally. There are many signs of this. Central banks have gone from selling to buying in recent years.

On the intellectual plane, I think there the consensus of many decades, namely that gold had been permanently removed from its monetary role, is changing. There is increasing discussion gold as a monetary metal among the elites. Several years ago, Benn Steil, a CFR economist wrote an opinion piece for the Financial Times (excerpted here) suggesting that the global gold standard worked better than the current system of floating rates. Robert Zoellick, who was president of the World Bank at the time, wrote a gold-friendly op-ed also in the FT a couple of years ago.

L.S.: What is your overall view on China?

R.B.: The popular perception of China an economic juggernaut on a path to eclipse the economies of the developed world. And how did that happen? Because their wise central planners chose an export-driven growth strategy. Many people now think that this strategy has gotten them to a point where they are deficient in domestic consumption, so they need to switch to a consumption-driven mode of economic growth; and that this also will be accomplished by the same wise central planners through a series of carefully designed five-year plans.

I think almost everything about this view is wrong; it is still largely a centrally planned economy and we know from the economics of the Austrian economist Ludwig von Mises, central planners cannot allocate resources.

L.S.: Why not?

R.B.: Mises wrote a paper in 1920, which became quite a famous and very controversial thesis in economics that was debated for decades. His paper was called Economic Calculation in the Socialist Commonwealth and you can find it for free at the Mises site.

If you have a very simple economy where people make consumption goods with their bare hands, this can be done with central planning. But Mises was trying to explain the economic growth that has occurred in the world from small villages to vast modern economies with millions of goods and a complex division of labor. How could this type of growth occur? The process requires the development of a complex inter-relationship of capital goods, natural resources, and division of labor.

In a modern economy, the number of things that could be produced is nearly unimaginably large. And the number of different production methods for even a single good is incalculable. Take gold for example – finding a deposit is quite complex. There are many ways to look for it. Magnetic fields, chemistry, electrical, drilling. How much drilling and where? And then, when you have the deposit, should it be open pit or underground? Should a resource estimate be established first or start mining and follow the vein? And what about the metallurgy, the chemistry? What type of electrical power? What types of labor? Refine the ore on site, or partially refine? Build roads, rail, or ship the ore? There are millions of decisions and each one needs to be fully answered down to the hire or purchase of specific pieces of capital and individual workers.

Mises’ point was that all of these production decisions, not only what gets produced and what does not, but how it’s done, can only be decided on the basis of prices. In particular Mises noted that the prices of capital goods are crucial to production decisions. Contrary to what you read endlessly in the financial news about consumption driving the economy, spending on capital goods is the major part of total spending.

Only with prices can you have accounting, which is the ability to calculate profit and loss. In a market economic system, the important decisions are made on the basis of an anticipated profit and loss, which is the difference between the expected prices received on sales and the costs.

Mises had the insight that prices of capital goods are only a meaningful tool for resource allocation if they are established by a competitive bidding process among entrepreneurs. Entrepreneurs must choose how much they are willing to pay to acquire a specific capital asset and hire the skilled workers they need. Entrepreneurs are people who put at risk their own capital, and will either earn a profit or suffer a loss.

The diversity of entrepreneurs is a key part of this. Each business firm or company founder has a unique view of their own market, which may be highly detailed and based on years of experience. Mises also noted that each entrepreneur has his idea about what the customer will want. The market is a decentralized process in which the entrepreneur who has the best plan for each particular asset, along with some cash, will end up in a position to choose how that asset gets used.

In my own former job, I worked for a company that was in a small sub-sector of a sub-sector. There are perhaps half a dozen people in the world who truly understood our industry, maybe fewer. The entire world is full of experts like this, people who understand a particular industry or product really well.

Can you imagine, for example, that we would have iPhones or Kindles if the technology industry was planned by a central committee? Before the iPhone, competition in the mobile industry was primarily over how many minutes per month you got on weekdays or weekends. When Steve Jobs decided to develop the iPhone, he risked $150 million of his shareholder’s money and took on the US mobile industry, who did not want a disruptive phone taking away the spotlight from their monthly plans.

Can you imagine, for example, that we would have iPhones or Kindles if the technology industry was planned by a central committee? Before the iPhone, competition in the mobile industry was primarily over how many minutes per month you got on weekdays or weekends. When Steve Jobs decided to develop the iPhone, he risked $150 million of his shareholder’s money and took on the US mobile industry, who did not want a disruptive phone taking away the spotlight from their monthly plans.

Central planning means the abolition of this type of competition. And that is the problem that Mises identified. There is no way to replace this competitive bidding process with a single planner or a planning committee. The central committee cannot bid against itself for the opportunity to acquire specific capital goods and labor. That would be nothing more than the left hand bidding against the right hand. They could assign fake prices to resources and pretend to calculate the best projects, but the numbers that would come out of this process would not be prices, they would be arbitrary numbers that did not reflect the best possible use of scarce productive resources. Mises showed that a central planner has no basis for making economic decisions, even if the process did not become entirely politicized, as it always does.

L.S.: So how does that apply to China’s growth prospects?

R.B: The China bull story as far as I can tell is based on the growth rate of GDP. Their economy is allegedly growing at 9%, if you believe the number. But the GDP number is more of a measure of spending. You can go along spending money for quite a while, but that doesn’t mean that it’s a useful allocation of resources in the face of scarcity. In the end if you have nothing that people want to show for it, it was wasted. And GDP does not capture that distinction.

The idea of export driven growth, it’s a contradictory concept. Economic growth means the ability of an economic system to produce more goods and services that people want and are willing to pay for, at a higher price than it cost to produce them. What they call export-driven growth is really a policy of holding their own currency exchange rate below the market rate in order to reduce the domestic monetary costs of their export industries. This creates a misallocation of labor and capital and a relative over-productive of export goods at the cost of fewer imports and fewer goods for domestic consumption.

If the cost of China’s policy were properly accounted for, it would be evident that the marginal export goods that is apparently produced at a profit (under the phony accounting of depreciating money) is in reality produced at a loss. But this loss is hidden because it is distributed over the entire population by reducing the purchasing power of their currency. And that impacts their ability to buy imported goods, or, as many domestically produced goods that have an import component.

They have a huge infrastructure bubble. They are building far more roads, bridges, power plants in relation to the rest of their capital structure. Bridges and roads to nowhere show up as GDP because spending is required to create them. But not all spending is created equal. Spending on thinks you don’t need or things that cost too much to produce is waste and it moves resources away from where they are needed to create real growth.

A lot of the writers in the West are in awe of China’s centrally planned economic system. A friend of mine, the American investment writer Chris Meyer, sent me news story a few years about the highly reputed UK fund manager Antony Bolton who had come out of retirement to manage a new China fund. Bolton cited the advantages of central planning compared to a market economy as one of his reasons for his enthusiasm. Things didn’t work out so well for Bolton. The fund has under-performed, which can happen for a lot of reasons besides believing in an incorrect political-economic theory. But I think that he came in right near the top of China’s planning bubble.

Economist Brad Setser wrote a paper around 2006 about the Chinese banking system. In his paper, he went back a number of years into the history of their banking system. Setser found that during this time, interest rates had been set at below-market levels by the central planners. This of course meant more demand for loans than banks could supply. Rather than rationing by price, resource allocation had been largely driven by political favoritism. Not surprisingly, most of the loans from this period went bad. The entire banking system eventually became nothing but a sea of bad loans. Then there was a bail-out, putting all of the bad loans in a bad bank. And then, they started over from zero and rebooted the whole system. But by the end of the time that Setser covered in his research, they had gotten right back where they started, full of bad loans again. More recently Edward Chancellor and Mike Monelly of the respected value investing firm GMO have produced a research piece saying more or less the same thing.

Overall they have a completely dysfunctional capital allocation process. That’s why I’m a bit of a skeptic on China.

L.S.: Last year the Austrian gold analyst Ronald Stöferle mentioned you in an interview with me for GoldSwitzerland. (2) Mr. Stöferle, in my opinion one of Europe’s best men in this field, said that you belong to the crème de la crème when it comes to the issue of price formation, and that you have something original and unique to say in your writings. So I am curious about this. But let’s begin the discussion with a more general question: In your opinion, where do you think that many analysts go wrong in their understanding of the gold market?

R.B.: I see four problems but in a way they are all different versions of one problem.

The first is a focus on the annual statistics. Whatever happened in the last year is not that significant because most of the gold that exists at the end of one year was there at the beginning of that year.

The second problem, which you could argue is a subset of the first one, is the emphasis mine supply. While a lot of ink or electrons are spilt on mine production, it has very little impact on the gold price.

The third is the vast amount of brainpower that goes into quantifying gold flows into market segments, such as industry, jewelry, coins, and funds. These quantities may be interesting for some purposes, but they’re not really that relevant if what you’re trying to do is understand the gold price, because there is not a connection between quantities and price in the way that most people think there is.

The last problem is the idea in some circles that there is a gold supply deficit. If you really look at the market, the concept doesn’t make sense. It’s based on a strange way of lining up the numbers to produce something like an optical illusion. The gold market, structurally, cannot be in a deficit in the way that any other commodity market could be in a deficit.

L.S.: We will discuss the last point in detail later. — As already mentioned, in the past you have written several pieces about the price formation mechanism in the gold market. Why have you chosen to focus on this area?

R.B.: I think the reason I have chosen to focus on this is that I see a lot of misunderstanding about this topic, and since very few people are active in this area, I have decided to take it on. I am hoping that through my writing and through interviews such as this one, I can play some part in shifting the thinking of the gold community.

There are a few others who get it. Stöferle who you mentioned has covered this in his gold report. Paul Mylchreest wrote about this exact issue when he was at Chevreux/Credit Agricole. Acting-man, a site that covers the Euro market, has some excellent content looking at gold and the price system from the correct perspective. James Turk and the people at GoldMoney are quite friendly to this concept. And I recall reading something by the fund manager John Hathaway in which he seemed to be saying approximately the same thing. I hope that I haven’t left anyone out.

I believe that the tide is slowly turning on this issue. While the incorrect view still predominates, increasingly the correct understanding is beginning to be expressed more frequently. A report such as Stöferle’s from a prominent research firm is a good sign.

L.S.: How does your view of gold price formation differ from the views of most analysts of the gold sector?

R.B.: I think I need to start out by giving a little background, and then proceed to directly answer your question. I am going to start by talking about where the wrong thinking comes from so you can see that it might make sense to someone to think that way. Then I will show where they go wrong and then, the correct way to think about it.

There are two different kinds of commodities and we need to understand the price formation process differently for each one. The first one I’m going to call, a consumption commodity and the other type I’m going to call an asset.

A consumption commodity is something that in order to derive the economic value from it, it must be destroyed. This is a case not only for industrial commodities, but also for consumer products. Wheat and cattle, you eat; coal, you burn; and so on. Metals are not destroyed but they’re buried or chemically bonded with other elements making it more difficult to bring them back to the market. Once you turn copper into a pipe and you incorporate it hull of a ship, it’s very costly to bring it back to the market.

People produce these things in order to consume them. For consumption goods, stockpiles are not large. There are, I know, some stockpiles copper and oil, but measured in terms of consumption rates, they consist of days, weeks or a few months.

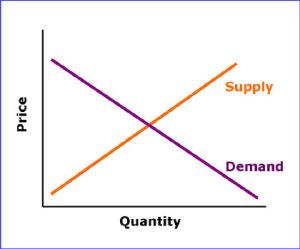

Now for one moment I ask you to forget about the stockpiles. Then, the only supply that could come to the market would be recent production. And that would be sold to buyers who want to destroy it. Without stockpiles, supply is exactly production and demand is exactly consumption. Under those conditions, the market price regulates the flow of production into consumption.

Now, let’s add the stockpiles back to the picture. With stockpiles, it is possible for consumption to exceed production, for a short time, by drawing down stock piles. Due to the small size of the stocks, this situation is necessarily temporary because stocks will be depleted, or, before that happens, people will see that the stocks are being drawn down and would start to bid the price back up to bring consumption back in line with production.

Now let’s look at assets. An asset is a good that people buy it in order to hold on to it. The value from an asset comes from holding it, not from destroying it. The simplest asset market is one in which there is a fixed quantity that never changes. But it can still be an asset even when there is some production and some consumption. They key to differentiating between consumption and asset is to look at the stock to production ratio. If stocks are quite large in relation to production, then that shows that most of the supply is held. If stocks are small, then supply is consumed.

Let me give you some examples: corporate shares, land, real property. Gold is primarily an asset. It is true that a small amount of gold is produced and a very small amount of gold is destroyed in industrial uses. But the stock to annual production ratio is in the 50 to 100:1 range. Nearly all the gold in the world that has ever been produced since the beginning of time is held in some form.

Even in the case of jewelry, which people purchase for ornamental reasons, gold is still held. It could come back to the market. Every year people sell jewelry off and it gets melted and turned into a different piece of jewelry or coins or bars, depending on where the demand is. James Turk has also pointed out that a lot of what is called jewelry is an investment because in some parts of the world there’s a cultural preference for people to hold savings in coins or bars but in other areas by custom people prefer to hold their portable wealth as bracelets or necklaces. Investment grade jewelry differs from ornamental jewelry in that it has a very small artistic value-added on top of the bullion value of the item.

So, now that I’ve laid out this background, the price of a good in a consumption market goes where it needs to go in order to bring consumption in line with production. In an asset market, consumption and production do not constrain the price. The bidding process is about who has the greatest economic motivation to hold each unit of the good. The pricing process is primarily an auction over the existing stocks of the asset. Whoever values the asset the most will end up owning it, and those who value it less will own something else instead. And that, in in my view, is the way to understand gold price formation.

Many of the people who follow and write about this market look at it as if it were a consumption market and they look at mine supply and industrial fabrication as the drivers of the price as if it were tin, or coal, or wheat. People who look at gold as if it were a consumption market are looking at it the wrong way. But now you can see where the error comes from. In many financial firms gold is in the commodities department, so a commodities analyst gets assigned to write the gold report. If the same guy wrote the report about tin and copper, he might think that gold is just the same as tin and copper. And he starts by looking at mine supply and industrial off-take.

I wonder if more equity analysts or bond analysts were active in the gold area, if they would be more likely to look at it the same way they look at those assets.

L.S.: In your writings, you mention quite often the marginal price theory. Where does this theory originate and what is it all about?

R.B.: Marginal price theory has been part of economic theory for well over a hundred years. Most historians of the field of economics itself see the so-called marginal revolution as the boundary between the classical school of economics and modern economics. I learnt marginal price theory from Murray Rothbard‘s book, Man, Economy and State, but it’s something you could learn in any course on economics.

Marginal price theory was developed to answer a question a lot like what we are discussing today. It was known as the diamond-water paradox. The question that classically economists could not answer is, “Why do diamonds cost so much more than bread when bread is necessary for human life and diamonds are a luxury?” The problem was that classical economists did not think in terms of individual units. The breakthrough was the realization that we need to think about economic action in terms of individual units. A marginal theory says that human action acts on individual units of a good. The last unit that you buy or sell is always the marginal unit. As an economic actor you’re thinking, “What do I want to do with this next dollar? Do I want one more unit, one more dollars’ worth of diamonds or one more dollars’ worth of bread?

L.S.: How does that apply to the gold market?

R.B.: Gold is an asset. People buy it in order to hold it. The price of gold is set as people balance, at the margin, the amount of additional units of gold they want to hold against additional units of other assets or cash they want to hold, or consumption.

If you think of the possible gold buyer as the guy who is saying, “Do I want to hold one more ounce of gold or this $1,800 that I have?” The answer to his question is going to be different for each person and for each additional ounce. You might say “yes, I want one more ounce of gold instead of $1,800”. Now, you have an ounce of gold and if I ask you the question again you might say, “No, now that I have bought that additional ounce, I’ve got enough gold”.

On the supply side, are the people who own gold. From their point of view they have to answer the question, “Do I want to keep holding this ounce of gold or do I want to sell it on the market and have $1,800?” That $1,800 might stay in cash or maybe they have another use in mind for it. The supply side is everyone who has any gold and the buy-side of the market is anyone who has any money that they might want to put into gold.

Now, we can eliminate people who don’t know what gold is, the ones don’t know where to buy it or how to buy it, and those don’t want any because they don’t understand it, or maybe they do understand it but they don’t like it. But that still leaves a large number of people who might add to their position some quantity of gold at the right price. The people who already own gold, they could be active on either side of the market as a buyer or a seller. I want to emphasize that everyone who owns any gold at all is part of the supply-side of the market, not all at the current price, but at some price.

In micro-economics there’s a nice formalism where they use supply and demand curves. If you took a micro course you would have seen those. Many people might feel more familiar with these concepts if they can see the curves. You can do a lot with these curves but you can’t forget that they supply and demand curves are a way of aggregating of the preferences of all the individuals in the market. Murray Rothbard does a great job of explaining this.

In the market, people rebalance between gold and dollars until they’re happy with what they own. At that point there will be no more trading if no one ever changed their mind. But now and again people do change their mind; they realize they want more of one thing and less of another thing. Then you have more trading to bring the market back into balance.

In finance there is a similar concept called, optimal portfolio theory in which they see portfolio management in terms where people are trying to hold the ideal amount of each different form of savings. The portfolio manager rebalances based on the expected properties of each asset until they have the right mix.

L.S: Is it realistic to assume that everyone is willing to sell their gold? The gold buyers are perceived as very strong hands with long time horizon, people who hoard for a crisis.

R.B.: Many of the people who have bought gold in the last few years are not remotely interested in selling at the current price or even double the current price, but there is always a price or some combination of price and circumstances where somebody would put some of their gold on sale — maybe not all of it but some of it. And people on the money side of the market are asking the same question in relation to gold. The market balances all of those choices out and you have a price that brings out the quantities on both sides of the market into balance.

Maybe that’s not totally true, maybe some gold is held by people who wouldn’t sell it for any reason. But I think that the concept of the gold bug who plans to take it all to the grave is over-stated. I asked a person the gold business whether gold retail trade is all selling and no buying. He told me, “No of course not, there are always buyers and sellers”. After all, what is the point of having a store of value if you never use the value? That is John Maynard Keynes and his parable of the cake that is never eaten. But Keynes was really painting a caricature of the capitalist system which encourages saving for the future. The future does arrives at some point, whether it is old age or emergency, and at that time, the value of additional saving is diminished relative to spending.

And it is important to understand the cost of owning gold is not necessarily the amount of money you could get by selling it. Prices are only a way of quantifying true costs. The cost of owning an ounce of gold is whatever other sort of economic opportunity that you are sacrificing by owning the gold instead. People who own gold are every day looking at “what other economic opportunities am I giving up by holding this ounce of gold?” and then “Do I want to shift the next ounce of gold somewhere else that will give me a better return or a better consumption experience?”. If you could swap an ounce of gold for one unit of the American Dow Stock Average that was at the time yielding 12% then the cost of owning an ounce of gold is not owning a unit of the DJIA. The cost of owning gold is the opportunity cost, of which holding cash instead is only one possible choice.

Let me give you another example; if the price of a new car that you like is twenty ounces of gold, you might prefer the gold. The cost of owning the gold is 1/20th of a car. But if the price of that car in gold ounces dropped to one ounce, you might say, “Nineteen ounces of gold is enough and I’d like to have that new car”. And at that point it makes sense to swap a single ounce of gold for a car. You still have nineteen ounces of gold, so you haven’t sold all of your gold, but at the margin, you have sold the least valued ounce for something that became more attractive.

L.S.: So your view is basically that of portfolio balancing. Do you see the price mechanism in the gold market as similar to the share market?

R.B.: Yes, in terms of the formal model of how pricing works it is similar. You see you have a relatively fixed quantity of a good and people are bidding the price up or down, based on who is the most motivated to hold that good, who is most willing to sacrifice the opportunity to hold a different asset or to increase their consumption.

Now, gold is different than shares in that gold is more of a cash-like asset whereas with shares you are buying an actual business that has a management team, products, and a financial statement. So, in that way it’s different. But in terms of the pricing process it’s quite similar.

L.S.: You use in your writings also the concept of “reservation demand”. Can you explain this further, please?

R.B.: There are two different expressions of demand for a good. If I trade with you, I supply one apple and I demand one banana and you do the opposite. We each demand something by offering something in supply. When there’s a buyer and a seller, the buyer demands and the seller supplies. That is exchange demand.

The concept of reservation demand is where you demand something by holding onto it rather than selling it. This concept might sound unfamiliar but it is very relevant to everyone’s life. We all have reservation demand for many goods. I have reservation demand at the moment for an auto, a dining room table, a couch, a mobile phone, and so forth. My reservation demand for cash in my pocket is $20. Any good that you’re any holding onto rather than selling, you are exercising reservation demand.

Most of the market research about gold deals with exchange demand, which has the advantage that you can measure it. But reservation demand is far more relevant to the price. The profile of reservation demand among people who own gold is the main determinant of the gold price from the supply side.

A very closely-related concept is reservation price. This is the price where you would be willing to sell a good that you currently hold. In the gold market, you can think of every ounce with a price tag on it. Or maybe today, it would be a QR code instead of a tag. That price depends on who owns that ounce of gold and their reason for holding it. Short-term traders might take a position for five minutes looking for a small move. If they got their $10 move they would sell and lock in a profit. You have other people who have a much longer time horizon, years or even decades, and a much higher expectation of where they’re going to sell. And even the same person will have a different price tag on each ounce. The first ounce you might be more willing to sell than your last ounce. It is important to understand that reservation prices are not necessarily money prices; they may be construed more broadly in terms of economic opportunities as I described just a moment ago.

You also might object that a lot of people may not know exactly what their reservation price is in money terms because it is impossible to know accurately what the purchasing price of money will be at a time when you might want to sell. And this is true. Many gold buyers are envisioning that we are going to experience hyper-inflation in some countries and their plan might be to look for distressed assets that go on sale during a hyperinflation. That would be the time to sell their gold, or more accurately, to swap their gold for assets. This type of person may conceive of the reservation price as, “When I can buy a small business, like a cleaners, for five ounces of gold” or “when I can buy a rental apartment for 10 ounces of gold”. People conceive of the reservation price more broadly in terms of what is going on in the world around them.

There is reservation demand on the money side of the market as well. Why does everyone not spend all of their money? Because we have reservation demand for money. The reason that you have any money at all and you haven’t spent it is you see some potential use for that money, possibly when you see something you need or want at a low enough price, that the good comes in ahead of your reservation price in so you buy the good.

The bid and ask that you see in the gold market at any point in time is the price offered by the marginal non-buyer and the price asked by the marginal non-seller. The marginal non-buyer is the person whose reservation price for their money is just below the ask and the marginal non-seller is the person whose reservation price for that ounce of gold is just above the bid. The equilibrium of the market is that you have the bid and the ask which are the best reservation prices are on each side.

L.S. Why do you object to the emphasis on annual statistics in looking at this market?

R.B: What I want people to take away from this interview is that the gold price is not primarily a way of rationing gold that was mined during the last year, it’s a way of rationing all of the gold in the world because all of the gold is held and everyone who holds it cares about the price one way or the other.

The gold market is not segregated into one market for the gold that was mined this year and another market for gold that was mined in past years. The buyer doesn’t care whether he’s buying a newly mined ounce of gold or buying from somebody who had purchased gold that was mined 100 years ago. All of the buyers are competing to buy and all of the sellers are competing to sell.

I think that the focus on annual numbers is another residual of the domination of this space by commodities-type thinking.

L.S. You have stated that mine supply is not a key factor driving the gold price. Most gold analysts would not agree with you. Please explain your view on this.

If you pick up a typical research report on a gold market from a research firm or a bank, you will find that the main portion of the report is about annual quantities. Annual mine production is the most important followed by the jewelry melted, jewelry bought, coin and bar sales, dental, industrial, and central bank. And these quantities are thought by most analysts to be critically important in determining the gold price but that is just not the case.

Gold is always owned by whoever has puts greatest value on it. The ask price is the value placed on gold by the individual who values their last ounce the least of anyone who owns gold, compared to the last buyer who got rationed out of the market, the guy who values gold the most of anyone who does not own that last ounce.

Mining add about 1% to the total supply each year. If the total amount of gold is 5.05 billion ounces rather than 5.0 billion, that allows a few more of what were the marginal non-buyers to become buyers.

I think of the miners and the gold destroyers – such as dentists and the electronics industry, as a small delta on top of the price formation process that is mainly about who is willing to bid the most to hold all of the gold. Mine supply is only a small share of all gold.

The only difference between a miner and someone else who owns the same amount of gold is that the miners pretty much have to sell because they are businesses and they have to cover costs. The investor who owns some gold doesn’t necessarily have to sell, they can hold as long as they want to or until they have a better place for their savings than gold. You can say that they are price takers.

You can think of the miner as coming in to that market and selling down into the bid side of the market a little bit. Of course the miner is going to enable some people to get into the market at a lower price than without the miner because those buyers are not forced to go up higher into the ask side of the market in order to buy their gold.

A lot of analysts go even further down the road to absurdity by looking at the growth rate of gold mining. If you start out from year 1 where mine supply is, let’s say 2000 tonnes, and in year 2 mine supply is 2,500 tonnes, that is an increase of 20%. So the thinking goes, if supply is up by 20%, then demand also has to go up by 20% and that looks like a lot. If buyers bought 2000 tons last year and this year you are asking them to buy the same and then 20% more, how is that going to happen? It’s really not a big influence. In math terms, mine supply is the first derivative and now we are talking about second derivatives.

L.S.: You have given your reasons for thinking that the impact of mining on the gold price is small. Do you have any way of quantifying that?

R.B.: I can’t say for sure but there are some ways to make an educated guess.

One is that mine supply only adds around 1% or 2% to the total stockpile of gold. You can think of mining as a form of gold inflation with a rate of around 1-2%. If we were looking at the supply of money in a country or shares of a stock we would expect the value to be diluted by something close to the growth rate. Miners are diluting the value of the existing gold stock by 1%. If this is correct, and if everyone who owned gold was trying to maintain a constant amount of gold in purchasing power terms, then all other things being equal, a 1% dilution would have a 1% impact on price.

Another way of looking at it is when the supply of gold is 5 billion ounces there is a price quotation, which is the best ask. Now one year later mining has brought us up to 5.05 billion ounces. A group of buyers was able to come in and buy the additional 50 million ounces. Where do those new buyers value gold? If we assume static preferences, maybe slightly above their buy price. Not a lot above their buy price or they would have become buyers the year before. So that would suggest a slightly lower price, depending on how deep you have to go down into the bids to fill the additional ounces.

I looked at some figures from geologist Brent Cook showing that all of the gold mined in any one year is about equal to a few days volume on the LBMA. And the LBMA is not the only market where gold is traded in the world. I’m not saying that the difference due to mining is equal to the ratio of trading days to volume. But the point is, selling the mined gold onto the market is a very small part of the market activity. It’s easily absorbed into a liquid market.

L.S.: In your most recent article you argue that many analysts are incorrectly bullish or bearish, because their data does not support their price outlook. Is that so?

R.B.: You see every day in the media statements like “Gold investment demand is up by 20 percent this year” and that’s supposed to be very bullish. Or “investment demand was down by 15 percent” and that is supposed to be bearish.

There is also I remember a wave of stories in the early 90s as the gold industry was increasing up exploration and bringing new properties on line, where it was popular to say, “Gold mine supply was 2000 tons this year and it’s going to be 2500 tons next year”. That is an increase of 25 percent in supply, and wow, that sounds like a big, big increase in supply. To keep up, the demand side of the market has to step up by 500 tons this year otherwise the price is going to be much-much lower. That would be a huge increase in demand. Where is all that demand going to come from to keep up with supply?

When you see statement like that, what does that mean, exactly? It means something like this. If investors as a sector had a net addition to their portfolio of 50 million ounces one year and the next year they added 60 million ounces they’re calling that a 20 percent increase in demand. And that’s supposed to be very bullish.

This way of thinking about the market is not logical. What they call “supply” and “demand” is the amount of gold that got moved around the market. And that is fine as far as it goes. The problem is when they go from the number to the price. Those numbers do not characterize the forces of supply and demand that do set the price.

L.S.: Then what do they mean by supply and demand? And why do you dislike their definitions?

R.B.: Let me explain how they come up with these numbers and what they’re supposed to mean and then, where they go wrong.

What analysts typically do is divide the market up into sectors such as mines, investment, jewelry, industrial and central banks and maybe funds or ETFs get their own sector. Often a country like China is considered a sector. They want to measure the amount of gold that was bought and sold that year by individuals or actors within each sector. Those are gross amounts. From grosses you can compute net amounts. The net is the difference between the gross bought and sold quantity for that sector. There’s always a net outflow from the mine sector because they’re in business to sell. For any other sector, the net might be a positive or a negative number during a year because people may have bought more jewelry than they sold, or the opposite. During any given year investors might on net have added to their positions or diminished their holdings.

When you read “supply” or “demand” in the financial media, the definition is not consistent from one place to the next. There are a lot of ways people slice and dice all of the numbers. Everyone does not do it the say way. However you do it, you have a number made by adding up some gross and net quantities. For example, one report might say that supply is mine supply plus gross jewelry scrap. Someone else might include gross investment purchases, and someone else might count only net investment as part of the demand number. When you read that demand is up, what they mean is that one of these contrived Rube Goldberg definitions that has the misleading name “demand” has changed from one year to the next.

Let me give you one example. The CPM Group (a research consultancy that produces in-depth reports on the gold and silver markets) does it like this: they define supply as the all of following: mine supply, the gross industrial sales, and gross jewelry sold. CPM defines demand as the sum of all of these: gross industrial purchases, gross jewelry purchases, net central bank activity and net investor activity.

CPM uses a mix of gross quantities and net quantities. This definition by itself strikes me as quite eccentric because of the mixture grosses and nets into the same aggregate. Gross quantities measure a flow, while nets are the change in magnitude of a stock. What happens when you add grosses and nets together? I have no idea. This reminds me of breaking the rules of dimensional consistency, something that the physics faculty at my university prohibited.

Now let’s delve into these net quantities a bit more. To simplify the situation, suppose there are only two sectors in the market. Let’s call those two sectors “mines” and “everyone else”. Then the relationship between the quantities is very simple. Whatever the miner sold somebody bought. There’s always a market for gold at some price. An ounce of gold is worth more than zero. Any quantity of gold that someone offers on the market will find a buyer at some price and that gold will end up in someone’s portfolio or maybe consumed. Mine supply gross (or net) sold is equal to everyone else net purchased. That is a simplified understanding of a two-sector market.

Now let’s complicate the model a bit more to get it closer to reality. If you have three sectors, mines, jewelry and investment, then you can have a net outflow from jewelry one year and that would have to show up as a net inflow into investment because all the quantities have to balance out. Everything still has to net out to zero across all sectors. The gold miners are always sellers but any other sector could be a net buyer or a net seller in any one year period.

You can keep making the model more complex by adding more and more sectors. Each time you add another sector to your model, that sector has inflows and outflows. But this doesn’t change the fundamental logic which is that every ounce that is sold in one place is purchased in another place. All of the flows have to balance out to the net change in the world’s total position, which is mine supply less destruction. And that is always a positive number as long as anyone has been counting.

Now, I’ve been saying that this is at best, not very useful, and at worst, misleading. By now you probably want to know, “what is the problem?” The problem is that these quantities and these flows have no causal relationship with the gold price. All we have done is to add up some of the volume in the market and shifts in aggregate holdings. But we are still no closer to the price because neither the volume of trading, nor position changes as are causes of the price. Quantities are not the cause of the gold price. Gross quantities are not the cause of the gold price. Net quantities are not the cause of the gold price. And so it must also be true that any Frankenstein monster number you invent, even if you give it a familiar name, like “supply” and “demand” also does not cause the gold price.

Suppose I tell you that there was a net flow of gold from sector A to sector B last year, then what is the impact on the gold price? There is no way to say. The gold price could be higher, lower or unchanged when gold moved from A to B. If the gold moved from A to B because the buyers on the A side were more aggressive and raised their bid prices, then you would see a higher price. If gold flowed because the people in B valued it less, so they were willing to let it go for less in return, then you would see a lower price. If both of those things happened, there would be a lot of trading but the price might end up about the same.

A price is a quantity of money that is exchanged for a quantity of gold. In these voluminous reports about mine supply and jewelry and everything, they’re only looking at quantities of gold. There is no way that looking at quantities alone can tell you anything about price because there is no money involved. It’s sort of like the is-ought problem in philosophy, which says that you cannot derive a sentence containing “ought” from any number of propositions that contain only “is”. You cannot make any conclusions about money if you do not have money in your premises. No matter how hard you study these quantities it won’t tell you anything about the price. Whatever the driver is of the price, it has to involve both gold and money.

L.S.: If not cause and effect, is there any relationship between these quantities and the gold price?

R.B. : Yes, it’s almost the opposite of what most people think. The gold price is formed by a balancing process, as investors shift different assets in order to hold the amount of gold, cash, and other assets they want. These quantities come about because of discrepancies between what people own, what they want, and the collective preferences of the rest of the market. These discrepancies are resolved by exchanging and that gets counted as a quantity. But these quantities do not drive the price. The more preference changes among the buyers and sellers, the greater the volume of trading required to get back to an equilibrium.

I recall Warren Buffet describing a cartoon of a financial news anchor with the caption, “There was no volume on the market today because everyone was happy with what they own”. This is quite funny but the serious point is that buying and selling comes about because there are people who wish to change their position in a way that is complementary to what someone else wants, so they are both able to change their positions to something that they like better. The one side wants more cash, less god; the other wants the opposite.

The volume of buying and selling shows how far out of adjustment people are between their own positions and the preferences of other people in the market which is what creates the opportunity to trade. Buying and selling as such do not cause the price, buying and selling come about because of a preference disequilibrium. That disequilibrium requires trading to equilibrate but it does not tell us at what price the trading occurs.

There might be a statistical correlation between, for example, a net inflow into one sector and higher (or lower) prices. If someone has a statistical model that works, that is great. But it’s not causal.

But it seems to me that even if someone has discovered correlations like that, they will be coincident with the price, rather than predictive. In order to forecast the price, you need an indicator that moves in advance of the price. You read all the time how bullish it is that people bought so many coins, or bars or whatever, but buying that was the cause of the price going up, then it would have already gone up due to the buying. That would not help you forecast at all.

L.S.: You say that the way supply and demand are reported in the financial media is confusing. Please explain to our readers your thought process in more detail.

R.B.: When the average reader, or even the quite sophisticated reader sees the word “supply” and “demand” they don’t think to ask, “what is definition of that word” because we already have a good intuitive feeling about what those words mean. And we all know that an increase in demand drives the price higher, while an increase in supply sets us up for a lower price. And that is true if you use the terms “supply” and “demand” correctly to mean as the intensity of investor preferences on each side of the market.

If the author got all their numbers right – and some of these firms go to a lot of trouble to count up every microgram of gold dust in the entire world – then these statements are accurate in a very limited sense. But it is not true that a quantity made out of the sum of various flows and position shifts has any relationship to the forces that set the market price.

Everyone will agree: “The price of gold is set by supply and demand”. But what does did we all just agree on? Correctly understood, this statement means that the price balances out the overall the set of choices people make to offer on their desired terms from each side of the market. The price results from balancing those two sides.

Suppose that instead of “supply” and “demand” these aggregates were called X and Y, if you like algebra. Now if I change my statement to say “The price of gold is set by X and Y” you are immediately going to ask “what do you mean by X and Y?” And when you find that X = A + B + (C – D) + (E – F), etc. and Y is something similar it starts to make a lot less sense. At that point your head will probably start exploding. When you use X and Y in place of “supply” and “demand”, you no longer have a true statement.

The problem happens by starting out from truth and then changing the definitions of terms so the statement looks the same but it is no longer means the same thing and the thing that it now means is not true. By using words that have a clear meaning in our minds, but using them to mean something else this creates immense confusion. And hardly anyone realizes this when they are reading an innocent-looking statement.

L.S.: If not by quantities, then can the gold price otherwise be analyzed quantitatively?

R.B.: The gold price is set by investor preferences, which cannot be measured directly. But I think that we understand the main factors in the world that influence investor preferences in relation to gold. These factors are the growth rate of money supply, the volume and quality of debt, political uncertainty, confiscation risk, and the attractiveness (or lack thereof) of other possible assets. As individuals filter these events through their own thoughts they form their preferences. But that’s not something that’s measurable.

I suspect that the reason for the emphasis on quantities is that they that can be measured. Measurement is the basis of all science. And if we want our analysis to be rigorous and objective, so the thinking goes, we had better start with numbers and do a very fine job at measuring those numbers accurately. If you are an analyst you have to write a report for your clients, after all they have paid for it, so they have to come up with things that can be measured and the quantity is the only thing that can be measured so they write about quantities.

And in the end this is the problem for gold price analysts, you’re talking about a market in which it’s difficult to really quantify what’s going on. I think that looking at some broad statistical relationships over a period of history, like gold price to money supply, to debt, things like that, might give some idea about where the price is going. Or maybe not, maybe you run into the problem I mentioned about synchronous correlations that are not predictive.

Part of the problem is that statistics work better the more data you have. But we really don’t have a lot of data about how the gold price behaves in relation to other things. The unbacked global floating exchange rate system has never been tried before our time. How many complete bull and bear cycles has the gold/fiat market gone through? My guess is that when we look back we will see that we are now still within the first cycle. Our sample size is one.

L.S.: Some people, for example the Gold Anti-Trust Action Committee (GATA), assume that the gold market is in a structural supply deficit which would require the gold price to be much higher in the absence of central bank selling. You do not agree with GATA that the gold market is in a supply deficit? What’s your thinking on that point?

R.B.: I should first explain what they mean by a deficit. A deficit implies a situation where demand exceeds supply. This is a sensible definition in some situations but it doesn’t apply to gold. It sounds logical but when you drill down into it, there are conceptual problems.

When would it make sense to talk about a deficit? Let’s go back to the consumption-type commodities. In the wheat market, it is possible that consumption could exceed production for a limited time until stock piles are used up, and then, you would only be able to consume what was produced. When stocks were exhausted, the price would have to go much higher in order to bring consumption in line with production. This type of deficit does not exist in the gold market because the gold market in a surplus of production over consumption every year.

But the bigger reason that it does not make sense to talk about a deficit is that unlike a commodity, the buyer does not destroy the commodity. The trade of gold is not drawing down any stock piles. When a transaction takes place, that does not reduce the total amount of gold in the world, it only changes ownership. Once an ounce of gold is sold, the buyer could then sell it to someone else, and they could sell it again. There is no limit to the amount of gold that can get shuffled back and forth between different people over time.

So how did they come up with the idea of a supply deficit? I’ll tell you how they do it. They are talking about a supply-demand deficit rather than production-consumption deficit. A deficit means that a number called “supply” is less than another number called “demand”. These definitions are problematic, due to the Frankenstein monster problem that I have discussed.

They define supply and demand using some combination grosses and nets. “Supply” is less than the “demand” and difference between the two is approximately the quantity sold by central banks. So this is the basis of why they say that there is, or was, a structural supply deficit that was made up by central bank selling.

Right away you should be suspicious about this because we know that if supply is defined the total quantity sold then demand is the total quantity bought then they have to be equal at the end of the year, because every time there is a transaction, a buyer and a seller are involved with the same quantity.

If you define annual gold supply as mine production plus scrap, plus net producer hedging but not official sales, and then define demand as everything else on the buy side, then when you add things up, then the difference is going to have to be the official sector selling because that wasn’t included in supply. You will get the same thing if you left out any other sector from the market from your definition of supply. For example, if you defined demand as all the gold that was bought by the different buyers and all the gold that was sold, accepting gold that was sold by China, then it would look like there was a supply deficit in the market that was made up by China. The difference between this type of deficit, which is not a real deficit, and a true deficit that you could have in in a commodity market, is that this deficit is an artifact of an illogical definition.

Where this really gets misleading is if you say that there is a 500 ton deficit, and you compare that to “supply” which is again misleadingly defined as mine supply, around 2500 tons, it looks like the market has a deficit equal to 20% of annual supply. In a commodity market, like copper, that would be a huge deficit because the stockpiles are maybe only equal to 20% of one year’s production. After one year of a deficit like that you would have run out, and then the market would hit a hard wall. But in the gold market, as I have shown, the data means nothing like that at all. The comparison is wrong on both counts: there no deficit and the supply is not represented by one year’s mine supply.

I won’t dispute that if central banks decided to sell 400 tons in one year and they wave a big white flag in front of their sale, as the Bank of England did, the price will be lower that year than if they had not sold, or if they had bought. In the late 90s, it really did appear that central banks were trying to get the worst possible sale price rather than the best. And I won’t dispute that at some point if central banks had continued to sell, then at some point would have sold all their gold and would have to stop selling. That is all true, but the way they talk about a supply deficit vastly overstates the importance of central bank selling.

L.S.: Do you agree with GATA that the precious metal markets are rigged and what is your opinion about GATA in general?

R.B.: I have no special expertise in the issues that they raised but I have been a follower of their reports since near the beginning and I read nearly everything that they publish. They have a daily email service where they pick out the most interesting stories in the gold market. I have been persuaded of the correctness of their main thesis, namely that a cartel of central banks conspired in the late 1990’s to hold down the gold price; that this strategy has become unsustainable; and that they are now in a controlled retreat.

I’m not sure of the motives of central bankers. GATA have cited some quotes and other evidence indicating that some of these bankers may have a belief that they could permanently kill off gold as an asset if they could force its price down low enough and hold it there for long enough. I suppose they must have thought that everyone would lose interest.

If they did think that that they could permanently exterminate gold, that would demonstrate a belief by central bankers that gold is money is merely a convention; and that once the convention was discarded or people have forgotten about it, people would abandon gold and we would have centrally planned paper money forever. But they obviously didn’t know who they were up against. Gold bugs are pretty stubborn.

I recall reading a report by a former Mitsui analyst Andy Smith, not exactly a friend of the gold bugs. Smith saw the progression from commodity money to paper money and central banking as a natural technological improvement, like those that occur in all areas in a free market economy. Just as we now have better mobile phones and better cars, we have replaced an outdated form of money with a more modern form of money.

This view fails to recognize any inherent advantages of commodity money over the centrally planned system of paper money. People have been using commodity money as long as there has been money, which is for thousands of years. That continuity has been interrupted briefly by paper systems. The reign of paper experiments has been short because that have ended badly. And then, the world has returned to a commodity.

This idea that a choice between a paper and a commodity system is purely conventional ignores the basic properties of monetary commodities, which have been known since ancient times. The properties have roots in physics, chemistry, geology and human nature. These realities will always drive human society in a direction toward commodity money. Even if commodity money were forgotten, it would be rediscovered because it has a basis in nature.

Or perhaps this was not their view. Maybe they did not think they could permanently destroy gold as an asset. Maybe the rigging was more of a short-term strategy to protect some of their friends who were short many tons of gold and had no ability to go into the market and buy that much. In that case, the central bank activity might have been a way of bailing out their friends, enabling them to cover, and then this thing turned out to be a lot bigger than they expected. They don’t know how to get out without driving up the price much, much higher. GATA has uncovered some evidence that the controlled retreat is a strategy to get out of their shorts without any big spikes in volatility.

In the end, I’m not sure exactly what the motives for the scheme were but I think GATA are substantially correct in their main contentions.

L.S.: But if now some people / institutions rig the gold market indeed, what does this mean for the theory of price formation? You know, theory versus the reality on the ground?

R.B.: There is the physical market and the paper market. My thought process and our discussion concern the physical market. GATA believes that central banks have sold a lot of physical gold.

But the more significant answer to your question would involve the use of paper markets to achieve a synthetic supply greater than what could be mobilized in the physical market. The GATA thesis is that price suppression mainly involves the short selling of short large amounts of paper which drag the physical market down along with it. And this could go on unless there was a boycott by the longs in which they insist on physical delivery.

Since I have no particular expertise in that area, I won’t say any more than that other that what they’re saying sounds plausible to me.

L.S.: We all know about the distain of some of the more successful value investors for Bullion. Why is it that Buffet and the ilk do not like gold? Furthermore, can gold hold the place in the value investor’s portfolio?

R.B.: The value investor school goes back to the work of Benjamin Graham. The way the value investor looks at the world is that every asset has two prices. There is the market price which is observable in the market, and then a theoretical price which they call, intrinsic value. The concept of intrinsic value is the primary innovation of the value school. There are difficulties in calculating it accurately, it involves guesswork and judgment but intrinsic value represents the price that a rational investor would pay for that business. It is a theoretical price, but based on economic logic, the asset should trade at its intrinsic value.

What they’re looking for is a situation where you have the price in the market much lower than intrinsic value and that’s where you should buy. You’re probably going to make money when you can do that because eventually the market will understand the rational economic value of the business.

How does the value investor estimate intrinsic value? There are various ways but they all rely on other market prices. If you look at the income statements of a business you get profits or you look at the cash flow and you have cash flows coming in. You have stream of money flows, how would you price that stream? You would price it by looking at what is the market paying for similar streams of income, either by comparing it to other comparable stocks or bonds or by using interest rates which is essentially the same thing.

Or you can do it from balance sheet standpoint. If the corporation has assets, those might be things like land, real estate, mineral deposits, regulatory permits, brands, patents. The economic value of these assets can be determined if there is an external market where you can price comparable assets. Then you can break the business up into pieces (on paper) and value the assets individually. If you can buy the assets for much less than the market place then that is also a buy within the value discipline.

The other thing the value investors really like is dividends or interest payments. This gives them a chance to earn some money while they’re waiting to be right. If you have a very high yielding asset and you’re able to hold it for five or six years, you might get your purchase price back, even if the price of the asset doesn’t go up. Then you are protected if the asset went to zero.

So now, I think we can see why value investors don’t like gold: because it doesn’t have cash flows, it doesn’t have dividends, it doesn’t have a balance sheet and therefore, it doesn’t have an intrinsic value in the sense that they use the term. The value investor looks at gold and says this stuff can be any price at all depending on what people are willing to pay for it. Andy Smith who I mentioned before, he came out with $90 gold forecast at one point. I guess he thought that someday everyone would wake up and just decide that gold was worth $90.

Value investors hate to buy something if they don’t know what it’s worth (and by that I mean intrinsic value) because they can’t ground that action in their rational framework. They think that such a move would be an irrational speculation, so they stay away from it.

I think that they are right within their framework, that you cannot buy gold for reasons like that because you cannot analyze it that way. Where I disagree with the value investors is that many of them think that that value investing is the only rational approach to risk, something that we all face in every area of life and we have to deal with it somehow.

I don’t think that any decision you make outside the value investment framework is irrational. I see rationality as broader in that we’re all trying to survive and adapt in this world with an uncertain future. We know that there are regularities in the world, that cause and effect relationships exist. Rationality means that we try to choose our own actions within that context.

Thousands of years of commodity money have been interrupted by brief but spectacular failures of paper money. And we know that the use of gold as a commodity money is rooted in geology, chemistry, metallurgy and aspects being a human being on this planet. For example, with our built-in optical system we can recognize gold pretty well. And given our size and strength as humans we are able to carry a decent amount of purchasing power – not too much, not too little – in the form as gold in our pockets. And so I don’t think it makes you a crazy person that you should want to have a portion of your savings in a good that has always maintained some value in a world where central bankers are desperately trying to destroy the entire monetary system.

L.S.: A controversial topic within both the gold community and the anti-gold crowd is whether gold is money. What is your view on that?

R.B.: Money is a medium of exchange. That means money is the thing that people ask for in return when they supply goods and services to the market. You often see money being defined as something having three properties: medium of exchange, store of value and unit of account. But my view – and this is in agreement with Austrian school economists Menger and von Mises – is that store of value and unit of account are not the definitional properties, they are derivative properties that money has because of its function as a medium of exchange. There can be other goods in the economy that function as a store value but not as a medium of exchange, like property for example. And I would include gold in that category. It is a store of value, maybe superior to the performance of money proper in that respect.

Whether gold is or is not money, is simple to determine. If you look around where you live and ask whether prices are quoted in terms of a particular thing then that will tell you if that thing is or is not money. Now, if I look around where I live here in San Francisco, prices are quoted in US dollars and in other places I’ve travelled in the world, prices are usually quoted in terms of a national currency, or sometimes in terms of dollars if the country has dollarized its monetary system.

Most prices here now are quoted in dollars. I have read somewhere that property values in Vietnam are sometimes quoted in gold so, in that case, it would be accurate to say that gold was functioning as money but for the most part world-wide, gold is not money at this time.

We went through a period here in San Francisco during the tech stock bubble in the 90s in which the prices of certain goods were quoted in terms of stock options on technology start-ups. That was a strange time. Companies could not hire workers for money wages; they had to offer stock options. Rents on business properties where the landlords would not accept money rents, they required a combination of money and stock options. Buyers were making offers on homes for sale in Palo Alto California consisting of a combination of money and stock options. I even read about a restaurant that was serving food to employees of a tech company for options instead of cash.

My interpretation of this strange phenomenon is that we were in a period of asset hyperinflation. Money was losing value so fast in terms of technology stocks people were reverting to the hyperinflation behaviour you see in end stages of a monetary collapse. In the late stages of a hyperinflation, people buy goods of any kind as fast as they can in order to get rid of money. This was the equivalent of people buying bed pans in Weimar. But that is a bit of a tangent.

Professor Salerno, an economist of the Austrian School who teaches for the Mises Institute said that when the US broke the last link between gold and the dollar, 1970 the economist Milton Freedman had forecast that gold would collapse. Friedman thought that the dollar was the only thing that was holding up gold.

Andy Smith’s view is similar. Smith was saying back in the 90s that central banks are stuck with all this gold that they no longer want. They know that it’s useless but how are they going to sell it? If they started liquidating, then that would announce to the world that gold is no longer money. All the stupid gold bugs, who hold it because they think that it is money, would realize that they had been played for fools, and the gold price would immediately collapse. Smith saw the Washington Agreements, an agreement among the major gold-owning central banks to restrict quantities sales each year, sort of like the OPEC cartel, as their solution to this problem. Smith characterized this as a form of welfare for the gold industry, as if banks were forming a cartel to keep the gold price up, not down. So in Smith’s view, central bank gold reserves only reinforce the perception that gold is still money, or, if not money, at least some kind of quasi-monetary thing that is of interest to central banks. That totally artificial perception was, according to Smith, the only thing restraining the gold price from a total collapse.

But this is all nonsense; Friedman and Smith are completely mistaken in their view. Governments do not define what money is. Ultimately, the market defines what money is and people will use centrally planned paper money only up to a point. The point where people reject paper money is when its purchasing power becomes so unstable that it is no longer of any reliable use as a store of value or unit of account, even for a short time. And when that happens, that is called hyperinflation.

The Austrian economist, Murray Rothbard, identified three phases of inflation; in the first phase the money supply expands but prices do not rise as much because people perceive a new influx of money as temporary and they prefer to save it rather than spend it all. The second phase is when people realize that inflation will continue and they start to spin down their cash reserves faster than money supply is growing, so prices outpace money supply growth. In the final phase, which von Mises called the crack-up boom, the public perceives that inflation never stop until, it will only accelerate. While it is theoretically possible that we could all adapt to using money that was losing 99% of its value each year, in practice that does not happen. At that point, people choose to exit from the monetary system an alternative store of value, either another form of money, or non-money.

We have an uneasy co-existence with state money because there is always that threat that its value erode or the threat of a bank credit deflation in which the purchasing power of each money unit increases but a lot of bank credit money is destroyed. If it happened to be your money that was destroyed, then you would be broke, even if the purchasing power of the remaining money has increased. We have this co-existence with state money because it’s already in use, that makes it convenient and all of the taxing and regulatory frameworks that we have to interact with are denominated in state-issued money.

In favor of gold, the adoption of gold as money is based on sound reasons. It has the characteristics of the ideal money which has been known since ancient times. The possibility of using gold as an ideal form of money will never go away as long as there is gold and there are people. And there is always this threat from the point of view of central bankers that society will reject their centrally planned monetary system and start using something else.

My view then of gold is no, it’s not money, not exactly but the continuing demand for gold arises from its function as a shadow money. It’s something that people hold to hedge against the possibility that it will become money or become more closely tied to money in the future. And even if it does not, the public’s valuation of gold functions as a check on the behaviour of the monetary authorities.

As central banks continue to issue vast quantities of unpayable debt, most of which will be monetized, we are never so far away from the possibility of a collapse that there is no need to have insurance against it.

L.S.: Final question; you’ve mentioned the strange time of the dot.com bubble. Do you think the excitement, the hype and the greed during that period will be nothing compared to the time when gold and silver will really begin their bubble phase?

R.B.: I do think we will have a bubble in gold, although it may take the form of a collapse of the monetary and a return to some form of gold as money in which case, the bubble will not end, it would simply transition over to the new system in which gold would go from being a non-money asset to money.

I have been following this market since the late 90s. I remember reading that gold was in a bubble at every price above 320 dollars. I very much like the writings of William Fleckenstein, an American investment writer. He has pointed out how often you read in the financial media that gold is already in a bubble, a point he quite rightly disputes. Fleckenstein has pointed out that the people who say this did not identify the equity bubble, did not believe that we had a housing bubble, nor have they identified the current genuine bubble, which in the bond market. But now these same people are so good at spotting bubbles that they can tell you that gold is in one.

Most of them did not identify gold as something which was worth buying at the bottom, have never owned a single ounce of gold, have missed the entire move up over the last dozen years, and now that they’re completely out of the market, they smugly tell us for our own good that gold is in a bubble and we should sell.

So, I don’t know that we need to listen to those people and take them very seriously.

L.S.: Should we begin to think about the possibility that gold is in a bubble when they buy gold?

M: Very good, yes. (laughs.)

L.S.: Thank you very much for taking your time, Mr. Blumen!

You are most welcome Mr. Schall. Thank you for allowing me to share my views with your readers.

SOURCES:

(1) Official Monetary and Financial Institutions Forum (OMFIF): “Gold, the renminbi and the multi-currency reserve system“, published January 2013 under:

(2) Compare Lars Schall: “The Seeds For An Even Bigger Crisis Have Been Sown”, Interview with Ronald Stoeferle, published at GoldSwitzerland on July 11, 2012 under: